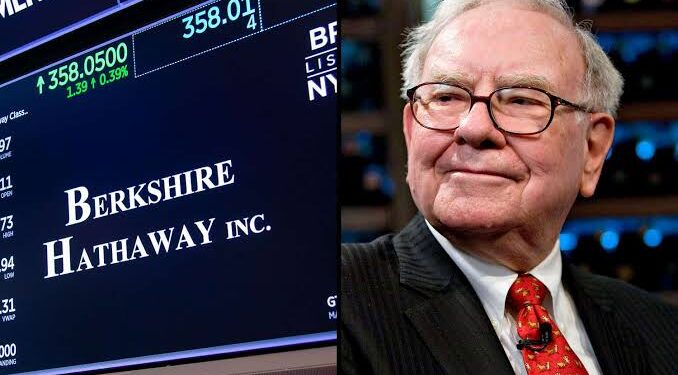

In a historic shift, Warren Buffett announced his decision to step down as Berkshire Hathaway’s CEO, recommending Greg Abel as his successor.

This move shocked shareholders and marked a significant change in the company’s leadership. Buffett, known for his investment prowess, has been at the helm of Berkshire Hathaway since 1970.

The company’s stock has seen tremendous growth under his leadership. Abel, currently vice chairman overseeing non-insurance businesses, has been tabbed as Buffett’s successor.

Key Takeaways

- Warren Buffett plans to step down as Berkshire Hathaway CEO by the end of the year.

- Greg Abel is recommended as his successor.

- The decision marks a significant change in the company’s leadership.

- Berkshire Hathaway’s stock has seen tremendous growth under Buffett’s leadership.

- Abel is currently vice chairman overseeing non-insurance businesses.

The Announcement That Shocked Wall Street

Berkshire Hathaway’s annual meeting turned into a historic moment with Warren Buffett’s unexpected news. The Oracle of Omaha, known for his investment prowess, shocked shareholders by announcing his intention to retire at the end of the year. This significant change in leadership has sent ripples through the financial community, with many investors and analysts eagerly awaiting the transition.

Warren Buffett’s Unexpected Retirement Plan

Buffett’s plan, known only to his children on the company’s board, was met with a standing ovation during the annual meeting. The surprise announcement left many in attendance, including Greg Abel, his designated successor, visibly moved. Abel, who is set to take over as CEO, has been with Berkshire Hathaway for several years and has been instrumental in the company’s energy sector.

Key Details of the Transition Timeline

The transition timeline indicates that Greg Abel will assume the role of CEO by the end of the year, with Buffett remaining as chairman. This gradual transition is expected to ensure continuity and stability within the company. Shareholders have reacted positively to the news, expressing confidence in Abel’s ability to lead Berkshire Hathaway into its next chapter.

| Transition Milestone | Timeline |

|---|---|

| Greg Abel takes over as CEO | End of the year |

| Warren Buffett remains as | Immediate |

| Full transition expected | Gradual, post-CEO transition |

Shareholder Reactions at the Annual Meeting

The reaction from shareholders was largely positive, with many expressing confidence in Abel’s leadership capabilities. The annual meeting, often a showcase for Berkshire Hathaway’s financial health and strategy, turned into a platform for discussing the company’s future under new leadership.

Warren Buffett’s Legendary Career at Berkshire Hathaway

Warren Buffett’s stewardship of Berkshire Hathaway has been a transformative journey, turning a struggling textile mill into a global conglomerate powerhouse. Since Buffett’s takeover, the company’s per-share value has compounded at an impressive 19.9% rate, resulting in a staggering 5,502,284% return for shareholders.

From Textile Company to Global Conglomerate

Berkshire Hathaway’s evolution under Buffett’s leadership is a remarkable story of strategic diversification and investment acumen. The company has expanded far beyond its textile roots, now boasting a diverse portfolio that includes insurance giants like GEICO, railroads such as BNSF Railway, and a multitude of other businesses.

Investment Philosophy and Major Acquisitions

Buffett’s investment philosophy, centered around value investing and long-term holdings, has been instrumental in Berkshire’s success. Major acquisitions have not only expanded the company’s reach but also contributed significantly to its growth. Some notable acquisitions include:

- GEICO: A significant player in the insurance industry

- BNSF Railway: A leading railroad company in North America

- Coca-Cola: A global beverage giant

The success of these investments underscores Buffett’s keen eye for value and his commitment to a long-term investment strategy.

Building the Berkshire Culture

The unique Berkshire culture, characterized by a decentralized management model and annual shareholder meetings, has been fostered under Buffett’s leadership. This culture encourages entrepreneurship and autonomy among its subsidiaries while maintaining a strong corporate identity.

| Year | Major Acquisition | Industry |

|---|---|---|

| 1996 | GEICO | Insurance |

| 2010 | BNSF Railway | Railroad |

| 1988 | Coca-Cola | Beverages |

Warren Buffett’s legacy at Berkshire Hathaway is not just about the financial success but also about building a culture that promotes long-term value creation and ethical business practices.

Understanding Warren Buffett’s Net Worth and Financial Impact

Warren Buffett’s $128 billion fortune is a testament to his value investing philosophy and business acumen. As the CEO of Berkshire Hathaway, Buffett has built a reputation for his successful investment strategies, which have significantly contributed to his net worth.

The Composition of Buffett’s Fortune

The majority of Warren Buffett’s wealth is attributed to his holdings in Berkshire Hathaway. His net worth is largely a result of the company’s stock performance over the years. The conglomerate’s diverse portfolio, which includes companies like Coca-Cola, American Express, and Geico, has been a key factor in Buffett’s financial success.

Philanthropy and Giving Pledge Commitments

Buffett is also known for his philanthropic efforts. He has pledged to give away the majority of his wealth during his lifetime and beyond. His commitment to philanthropy is evident in his participation in the Giving Pledge, a campaign that encourages billionaires to donate a significant portion of their wealth.

- Donation of billions to the Bill and Melinda Gates Foundation

- Support for various charitable causes through the Buffett Foundation

- Encouragement of other billionaires to follow suit through the Giving Pledge

Wealth Accumulation Strategy and Lessons

Buffett’s wealth accumulation strategy, centered around long-term value investing, offers valuable lessons for investors. Key principles include patience, discipline, and a focus on intrinsic value. By understanding and applying these principles, investors can potentially achieve significant financial gains over time.

- Investing in companies with strong fundamentals

- Avoiding emotional decisions based on market fluctuations

- Focusing on long-term growth rather than short-term gains

Who is Greg Abel? Profile of Berkshire’s Next Leader

Greg Abel, a key figure within Berkshire Hathaway, is being groomed to lead the company into a new era. As the current vice chairman overseeing non-insurance businesses, Abel has been instrumental in shaping Berkshire’s future.

Professional Background and Rise Within Berkshire

Abel joined Berkshire Hathaway through its acquisition of MidAmerican Energy, where he held a significant leadership role. Since then, he has risen through the ranks, taking on more responsibilities within the company. His hands-on leadership style and ability to drive growth have been key factors in his success.

Under Abel’s guidance, Berkshire Hathaway Energy has made significant strides, expanding its renewable energy portfolio and enhancing its operational efficiency. His expertise in the energy sector has been invaluable to Berkshire’s strategic decisions.

Leadership Style and Business Philosophy

Abel’s leadership approach is characterized by a deep understanding of the businesses under his supervision. He is known for his collaborative management style, which fosters a culture of innovation and accountability within the organization.

His business philosophy closely aligns with Warren Buffett’s value investing principles. Abel focuses on long-term sustainability and prudent financial management, ensuring that Berkshire’s subsidiaries remain competitive and profitable.

Personal Life and Values Alignment with Berkshire

Abel’s personal values and professional ethos are closely aligned with Berkshire Hathaway’s core values. He is known for his integrity, work ethic, and commitment to excellence.

| Key Traits | Description |

|---|---|

| Leadership Style | Hands-on, Collaborative |

| Business Philosophy | Value Investing, Long-term Focus |

| Personal Values | Integrity, Work Ethic, Excellence |

As Berkshire Hathaway prepares for the transition, Greg Abel’s profile offers insights into the company’s future leadership. With his strong background and alignment with Berkshire’s values, Abel is well-positioned to lead the company into its next chapter.

Greg Abel, Warren Buffett, and the Future of Berkshire’s Investment Strategy

As Greg Abel succeeds Warren Buffett as CEO of Berkshire Hathaway, the investment community watches closely to see how the company’s strategy may evolve. With a proven track record at Berkshire Energy, Abel is expected to bring a fresh perspective to the role.

Similarities and Differences in Investment Approach

While Greg Abel’s investment philosophy shares some similarities with Warren Buffett’s value investing approach, there may be differences in their strategies. Abel’s experience in managing Berkshire’s energy businesses has demonstrated his ability to navigate complex markets and make informed investment decisions.

Abel’s investment strategy is likely to continue focusing on long-term value creation, leveraging Berkshire’s strong financial position and diversified portfolio. His approach may also incorporate innovative elements, potentially including a greater emphasis on emerging sectors.

Abel’s Track Record at Berkshire Energy

Abel’s success in managing Berkshire Energy showcases his capability in handling large-scale investments and his understanding of the energy sector. This experience is expected to inform his decisions as CEO, potentially leading to strategic investments in renewable energy and other areas.

What Shareholders Can Expect Under New Leadership

Under Greg Abel’s leadership, Berkshire Hathaway’s future is likely to be characterized by continued disciplined investing and a commitment to the company’s core values. Shareholders can expect a steady hand guiding the company through changing market conditions, with a focus on long-term growth and stability.

The transition to Greg Abel as Warren Buffett’s successor marks a significant milestone for Berkshire Hathaway, presenting both opportunities and challenges. As the company navigates this change, its investment strategy will be closely watched by investors and analysts alike.

Why Gregory Abel Was Selected as Buffett’s Successor

The selection of Greg Abel as Warren Buffett’s successor is a strategic move that reflects Buffett’s confidence in Abel’s leadership abilities. This decision is the culmination of a thorough evaluation process, considering various factors that would ensure a smooth transition at Berkshire Hathaway.

Buffett’s Public Reasoning Behind the Choice

Warren Buffett has publicly praised Greg Abel’s leadership qualities and his significant contributions to Berkshire’s success. Abel’s role in overseeing Berkshire’s non-insurance businesses has been particularly noteworthy. Buffett cited Abel’s ability to drive growth and his deep understanding of the conglomerate’s diverse operations as key reasons for his selection.

Charlie Munger’s Influence on the Decision

Charlie Munger, Berkshire’s vice chairman, has also played a crucial role in the decision-making process. While the exact extent of his influence is not publicly disclosed, it is known that Munger has worked closely with Buffett in evaluating potential successors. Munger’s endorsement of Abel would have carried significant weight, given his long-standing partnership with Buffett and his deep understanding of Berkshire’s culture.

Abel’s Qualities That Won the Board’s Approval

Greg Abel’s ability to maintain Berkshire’s unique culture while driving business growth was a crucial factor in winning the board’s approval. Some of the key qualities that Abel brings to the table include:

- Proven leadership track record: Abel has successfully led Berkshire’s energy business, demonstrating his capability to manage large-scale operations.

- Strategic vision: Abel has shown a keen understanding of the businesses under his management, making strategic decisions that align with Berkshire’s long-term goals.

- Alignment with Berkshire’s values: Abel’s personal and professional values are closely aligned with those of Berkshire Hathaway, ensuring continuity in the company’s culture and operations.

Overall, the selection of Greg Abel as Warren Buffett’s successor is a testament to his leadership abilities and his potential to lead Berkshire Hathaway into its next chapter of growth and success.

The Succession Planning Process at Berkshire Hathaway

As Warren Buffett steps down as Berkshire Hathaway’s CEO, the company’s succession planning process comes under the spotlight. Berkshire Hathaway’s transition plan has been years in the making, with Greg Abel being identified as Buffett’s successor in 2021.

Years of Speculation and Preparation

The speculation about Warren Buffett’s successor has been ongoing for years. Berkshire Hathaway’s board has played a crucial role in identifying and grooming the next leader. The company’s succession planning process has been thorough, ensuring a smooth transition.

The Role of Berkshire’s Board in the Decision

Berkshire Hathaway’s board has been instrumental in the decision-making process. They have been involved in identifying the key qualities required for the next CEO and have endorsed Greg Abel as the ideal candidate. The board’s involvement has ensured that the transition is well-planned and executed.

How the Transition Will Be Managed

The transition is expected to be managed smoothly, with Buffett remaining as chairman until his death. This will ensure continuity and stability for the company. The following table outlines the key aspects of the transition plan:

| Transition Aspect | Details | Timeline |

|---|---|---|

| CEO Succession | Greg Abel takes over as CEO | 2023 |

| Chairman Role | Warren Buffett remains as Chairman | Until his death |

| Board Oversight | Berkshire Hathaway’s board continues to oversee the company | Ongoing |

The succession planning process at Berkshire Hathaway has been a long-term effort, ensuring that the company is well-prepared for the future. With Greg Abel at the helm, Berkshire Hathaway is poised to continue its legacy under new leadership.

Market and Industry Reaction to Buffett’s Retirement

As news of Warren Buffett’s retirement broke, the market reacted with a mix of surprise and caution. Berkshire Hathaway’s stock has shown resilience in the face of this significant change, outperforming the broader market with an 18% year-to-date rise compared to a 3% drop for the S&P 500.

Impact on Berkshire Hathaway Stock

The market’s positive response to Buffett’s retirement announcement is largely attributed to the confidence investors have in Greg Abel, the designated successor. Berkshire Hathaway’s stock performance is being closely watched as an indicator of how well the transition is being received.

Analyst Perspectives on the Transition

Analysts have offered varied perspectives on the transition, with some expressing confidence in Abel’s ability to lead Berkshire Hathaway. As one analyst noted, “Greg Abel has a proven track record, particularly in managing Berkshire’s energy business.” The transition is seen as a positive step by many, given Abel’s deep understanding of the company’s operations.

Competitor Responses to the Changing Landscape

Competitors are taking note of the change in leadership at Berkshire Hathaway, with some adjusting their strategies in response. As

“The transition at Berkshire Hathaway presents both challenges and opportunities for competitors in the financial and investment landscape.”

noted by a financial expert, the shift is likely to have far-reaching implications.

The Challenges Facing Abel as Berkshire’s New CEO

With Warren Buffett’s departure as CEO, Greg Abel inherits a complex legacy that requires a delicate balance of continuity and innovation. As the new leader of Berkshire Hathaway, Abel will face several significant challenges that will test his leadership skills and investment acumen.

Filling the Shoes of an Investment Legend

One of the most pressing challenges Abel faces is living up to the standards set by Warren Buffett, an investment legend. Buffett’s success has created high expectations among shareholders, and Abel will need to demonstrate his ability to navigate the complex world of finance effectively. Abel’s track record at Berkshire Energy and his role in managing Berkshire’s insurance businesses will be crucial in establishing his credibility.

Navigating a Changing Economic Environment

The global economic landscape is becoming increasingly volatile, with factors such as trade tensions, interest rate fluctuations, and technological disruptions posing significant challenges. Abel will need to be agile and forward-thinking in his investment approach to ensure Berkshire Hathaway remains competitive and profitable.

Maintaining Berkshire’s Unique Corporate Culture

Berkshire Hathaway is known for its distinctive corporate culture, which includes a decentralized management model and an annual shareholder meeting tradition. Preserving these unique aspects will be essential to maintaining the company’s identity and keeping shareholders engaged.

Preserving the Decentralized Management Model

The decentralized management model has been a key factor in Berkshire’s success, allowing subsidiaries to operate with a high degree of autonomy. Abel will need to ensure that this model continues to thrive under his leadership.

Continuing the Annual Shareholder Meeting Tradition

The annual shareholder meeting is a beloved tradition at Berkshire Hathaway, providing a platform for shareholders to engage with the company’s leadership. Abel will need to maintain the spirit of this event while potentially introducing new elements to keep it relevant and engaging.

As Abel embarks on his new role, he will need to draw on his experience and expertise to address these challenges. By doing so, he can ensure a smooth transition and position Berkshire Hathaway for continued success in the future.

Conclusion: The End of an Era and Berkshire’s Next Chapter

Warren Buffett’s retirement as Berkshire Hathaway’s CEO in 2025 marks a significant shift in the company’s leadership. As the investment world adjusts to this change, the appointment of Greg Abel as Buffett’s successor has instilled confidence in Berkshire Hathaway’s future.

With a proven track record and a deep understanding of Berkshire’s core values, Abel is poised to lead the company through its next chapter. Berkshire Hathaway’s future under Abel’s leadership looks promising, with a continued focus on value investing and strategic acquisitions.

As shareholders and stakeholders look ahead, they will be watching closely to see how Abel navigates the challenges and opportunities that lie ahead for Berkshire Hathaway. With a strong foundation and a clear vision, Berkshire is well-positioned for continued success under Abel’s guidance, ensuring a bright future for the company.

FAQ

Who is Greg Abel and what is his role at Berkshire Hathaway?

Greg Abel is the vice chairman of Berkshire Hathaway, overseeing non-insurance businesses. He has been recommended by Warren Buffett as his successor as CEO.

Why is Warren Buffett stepping down as Berkshire Hathaway’s CEO?

Warren Buffett has announced his decision to step down as CEO, recommending Greg Abel as his successor. The exact reasons for his decision are not explicitly stated, but it marks a significant change in the company’s leadership.

What is the expected timeline for the transition of leadership at Berkshire Hathaway?

Greg Abel is expected to take over as CEO by the end of the year, with Warren Buffett remaining as chairman. This transition timeline is designed to ensure continuity and stability for the company.

How has the market reacted to Warren Buffett’s retirement announcement?

Berkshire Hathaway’s stock has shown resilience, outperforming the broader market. Analysts have offered various perspectives on the transition, with some expressing confidence in Abel’s ability to lead the company.

What are the key challenges facing Greg Abel as the new CEO of Berkshire Hathaway?

Abel will face several challenges, including filling the shoes of Warren Buffett, navigating a changing economic environment, and maintaining Berkshire’s unique corporate culture.

Will Berkshire Hathaway’s investment strategy change under Greg Abel’s leadership?

While Abel’s investment approach shares similarities with Buffett’s, there may be differences in their strategies. Shareholders can expect a continued focus on disciplined investing and a commitment to Berkshire’s core values.

What is Warren Buffett’s net worth, and how has he accumulated his wealth?

Warren Buffett’s net worth is estimated to be around $128 billion, primarily composed of his holdings in Berkshire Hathaway. His wealth accumulation strategy, focused on long-term value investing, offers valuable lessons for investors.

How has Warren Buffett contributed to Berkshire Hathaway’s success?

Buffett transformed the company from a textile mill into a global conglomerate with a diverse portfolio of businesses. His investment philosophy, centered around value investing and long-term holdings, has been instrumental in Berkshire’s success.

What is the significance of Greg Abel’s leadership style and business philosophy?

Abel’s leadership style is characterized as hands-on, with a focus on maintaining Berkshire’s unique corporate culture. His business philosophy aligns closely with Buffett’s value investing approach, ensuring continuity in the company’s operations.