Republicans in Congress are moving forward with a comprehensive plan to overhaul the way Americans pay for college. The GOP-led committee in the U.S. House of Representatives has unveiled a sprawling, 100-page budget bill that aims to reshape the college financial aid system.

The proposed GOP student loan reform includes significant changes to the current system, with a focus on simplifying repayment plans and adjusting eligibility for Pell Grants. These updates are part of broader student loan policy updates aimed at making college more accessible while ensuring the sustainability of financial aid programs.

Key Takeaways

- Simplified repayment plans for borrowers.

- Stricter eligibility criteria for Pell Grants.

- Potential impact on colleges and universities.

- Changes aimed at improving the financial aid system.

- Reforms part of a larger budget bill.

The GOP’s New Student Loan Overhaul: A Comprehensive Overview

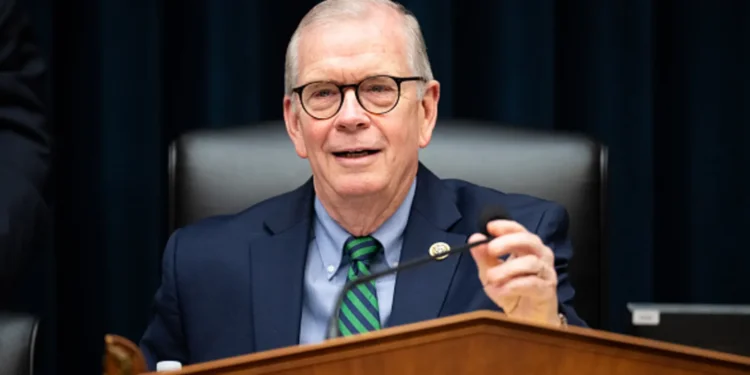

Chairman Walberg’s proposal is set to revolutionize the student loan landscape in the US. As the chair of the Education and Workforce Committee in the House, Rep. Tim Walberg, a Michigan Republican, has introduced the “Student Success and Taxpayer Savings Plan.” This plan aims to simplify the student loan system and save hundreds of billions of dollars, paving the way for broader tax cuts.

Chairman Walberg’s “Student Success and Taxpayer Savings Plan”

The “Student Success and Taxpayer Savings Plan” is a comprehensive approach to reforming the student loan system. Key aspects of the plan include simplifying the repayment process and making it more efficient. By consolidating multiple repayment plans into a more streamlined system, the plan aims to reduce complexity and make it easier for borrowers to manage their debt.

The plan also focuses on improving the overall efficiency of the student loan system, ensuring that taxpayer dollars are used effectively. This involves making adjustments to the Pell Grant program and other forms of federal aid to make them more targeted and effective.

Key Components of the Republican Reconciliation Bill

The Republican reconciliation bill includes several key components that are designed to work together to achieve the goals of the “Student Success and Taxpayer Savings Plan.” One of the primary components is the simplification of the repayment plan options, making it easier for borrowers to understand and manage their debt.

- The bill proposes to consolidate multiple repayment plans into a simpler system.

- It aims to make the Pell Grant program more targeted and effective.

- The plan also includes measures to improve the overall efficiency of the student loan system.

By understanding these key components, it’s clear that the GOP’s new student loan overhaul is designed to make significant changes to the current system. The plan’s focus on simplification, efficiency, and effectiveness is aimed at benefiting both borrowers and taxpayers.

Student Loans Would Cost More and Fewer People Would Be Eligible for Pell Grants Under the GOP Proposal

The GOP’s new proposal for student loan reform has sparked debate over its potential impact on college affordability. Critics argue that the legislation would make it harder for students, especially those from low-income backgrounds, to get into college, graduate, and pay back their debts.

The proposed changes aim to simplify the student loan system by reducing the number of repayment plans. However, this simplification comes with potential drawbacks, including increased costs for students and stricter eligibility criteria for Pell Grants.

Projected Increase in Student Loan Costs

Under the GOP proposal, student loan costs are expected to rise, making it more challenging for students to afford higher education. The increased costs will likely affect students from low-income backgrounds the most, as they rely heavily on financial aid to pursue their education.

A closer examination of the data reveals the potential financial implications of the proposal. The following table illustrates the projected increase in student loan costs under the GOP plan:

| Income Level | Current Loan Costs | Projected Loan Costs Under GOP Proposal |

|---|---|---|

| Low-Income | $10,000 | $12,000 |

| Middle-Income | $15,000 | $18,000 |

| High-Income | $20,000 | $22,000 |

Narrowing Eligibility Criteria for Federal Aid

The GOP proposal also includes changes to the eligibility criteria for Pell Grants, making it more difficult for students to qualify. The bill would raise the number of hours students need to study each term to qualify for Pell Grants, potentially excluding students who cannot meet this requirement.

The impact of these changes on Pell Grant eligibility is significant. As shown in the data, the stricter requirements could lead to a substantial reduction in the number of students eligible for federal aid.

As the debate over the GOP’s student loan reform continues, it is essential to consider the potential consequences of these changes on college affordability and accessibility.

Slashing Repayment Plan Options: What’s Changing?

The GOP’s student loan reform proposal seeks to simplify the federal student loan system by consolidating repayment plans. Currently, there are around a dozen repayment plans available to borrowers. The new plan aims to slash repayment plan options and introduce a more streamlined approach.

The legislation proposes replacing existing plans with a new Repayment Assistance Plan, which will significantly alter how borrowers manage their debt. This overhaul is part of the broader effort to overhaul the student loan system, affecting how Republicans plan to shake up Pell Grants and student loans.

Under the proposed changes, borrowers will have fewer options for managing their student loans, potentially impacting those who rely on income-driven repayment plans. The student loan repayment overhaul is expected to have significant implications for borrowers, making it essential to understand the potential effects of these changes.

As the proposal moves forward, it’s crucial to consider how these changes will affect borrowers and the overall student loan landscape.

FAQ

What is the main goal of the GOP’s student loan reform?

The main goal is to overhaul the student loan system, making changes to repayment plans and Pell Grants, as outlined in Chairman Walberg’s “Student Success and Taxpayer Savings Plan”.

How will the GOP’s plan affect Pell Grant eligibility?

The plan proposes stricter eligibility criteria for Pell Grants, potentially reducing the number of students who qualify for federal aid.

What changes are being made to student loan repayment plans?

The GOP’s plan introduces a new Repayment Assistance Plan, reducing the number of repayment plan options available to borrowers.

How might the GOP’s proposal impact student loan costs?

The plan could lead to increased costs for student loan borrowers, as the new repayment plan and changes to Pell Grants may result in higher expenses for students.

What is the Republican Reconciliation Bill, and how does it relate to student loans?

The Republican Reconciliation Bill includes provisions related to student loan reform, outlining the key components of the GOP’s plan to overhaul the student loan system.

How will the GOP’s plan affect low-income students?

The plan’s impact on low-income students is a concern, as stricter Pell Grant eligibility criteria and increased student loan costs may affect their ability to afford college.

What is the “Student Success and Taxpayer Savings Plan”?

The “Student Success and Taxpayer Savings Plan” is Chairman Walberg’s proposal to reform the student loan system, aiming to improve student outcomes while reducing costs for taxpayers.