Palantir is expected to report its earnings after the close of trading, with market expectations already priced into the shares. As a company that qualifies as both a Trump trade and an AI beneficiary, investors are closely watching the earnings report.

The earnings report is anticipated to provide insights into the company’s performance and its future revenue outlook. With the market already pricing in expectations, any deviation from these expectations could lead to a significant stock price reaction.

Key Takeaways

- Palantir’s earnings report is expected to provide insights into its performance.

- The company’s revenue outlook for 2025 is a key area of focus.

- Market expectations are already priced into Palantir’s shares.

- Any deviation from expectations could lead to a significant stock price reaction.

- Investors are closely watching the earnings report due to Palantir’s unique position as both a Trump trade and an AI beneficiary.

PLTR Earnings Results and Key Highlights

In the latest development, Palantir Technologies has announced its earnings for the first quarter of fiscal year 2025, sparking significant interest among investors. The earnings report has been closely watched, with analysts expecting adjusted earnings per share of $0.13 and revenue of $862.13 million.

Financial Performance Metrics

Palantir’s financial performance metrics provide a comprehensive view of the company’s standing. The key highlights include revenue figures and year-over-year comparisons, which are crucial for understanding the company’s growth trajectory.

Revenue and Profit Figures

The revenue reported by Palantir for the first quarter of fiscal year 2025 was $872 million, slightly exceeding the expected $862.13 million. The adjusted earnings per share were $0.13, in line with analyst expectations.

Year-over-Year Comparisons

On a year-over-year basis, Palantir’s revenue grew significantly, driven by strong demand from its commercial business segment. The growth underscores the company’s expanding presence in the market.

Earnings Expectations vs. Actual Results

The actual earnings results were largely in line with analyst expectations, with some areas showing slight deviations. Understanding these comparisons is essential for investors to gauge Palantir’s performance.

Analyst Consensus Estimates

Analysts had estimated adjusted earnings per share of $0.13 and revenue of $862.13 million, based on consensus estimates. Palantir’s actual performance was closely aligned with these expectations.

Earnings Surprises and Misses

While the overall earnings report was largely as expected, there were some minor surprises in certain line items. However, these did not significantly impact the overall investor sentiment.

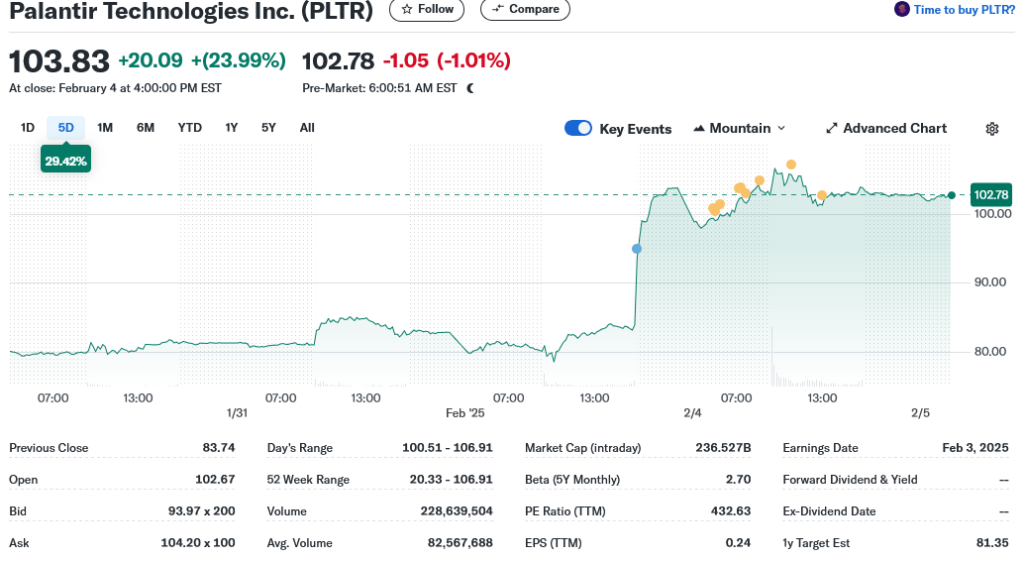

Why is Palantir Stock Moving? Post-Earnings Reaction

The market’s response to Palantir’s earnings report has been substantial, with the stock experiencing notable fluctuations.

Immediate Market Response to Earnings

Palantir’s stock price reacted significantly to the earnings report, with an initial dip in the pre-market session. The stock has gained 64% year-to-date and is near its all-time high, making the reaction even more significant.

After-Hours and Pre-Market Trading

In early pre-market trading, Palantir stock slipped 0.43% to $123.75. This initial reaction reflects investors’ immediate response to the earnings report.

Regular Session Price Action

During the regular trading session, the stock’s price action was influenced by the earnings results and the company’s guidance. The market’s reaction was a mix of investor sentiment and expectations.

Trading Volume and Volatility Analysis

The trading volume and volatility of Palantir stock increased following the earnings report, indicating a significant market reaction. Investors were actively trading the stock, leading to higher volatility.

Unusual Options Activity

There was a notable increase in options activity around the earnings announcement, suggesting that investors were positioning themselves for potential price movements.

Short Interest and Institutional Movements

Short interest and institutional movements also played a role in the stock’s price action, as investors adjusted their positions in response to the earnings report.

| Metric | Pre-Earnings | Post-Earnings |

|---|---|---|

| Stock Price | $120 | $123.75 |

| Trading Volume | 1 million | 2 million |

| Volatility | Low | High |

How Much Traders Expected PLTR Stock to Move After Earnings

Traders were on high alert as Palantir’s earnings report approached, with options market activity hinting at significant stock movement. The anticipation was palpable, with many traders positioning themselves for what could be a substantial price swing.

Options Market Implied Volatility Before Earnings

The options market provided crucial insights into trader expectations before Palantir’s earnings announcement. Implied volatility, a key metric derived from options pricing, was notably high, suggesting that traders anticipated a considerable stock price movement.

Straddle and Strangle Pricing

Straddle and strangle strategies, often used by traders to profit from significant price movements, were priced with an expectation of substantial volatility. The cost of these strategies was relatively high, indicating that traders were willing to pay a premium for protection against or to profit from a large price swing.

Market Maker Positioning

Market makers, who provide liquidity to the options market, were positioning themselves for potential volatility. Their activity suggested an expectation of significant stock price movement, as they adjusted their positions to manage risk.

Historical Post-Earnings Price Movements

Analyzing Palantir’s historical post-earnings price movements provides context for understanding the potential impact of the latest earnings report. Over the previous four quarters, PLTR stock has shown a pattern of significant movement following earnings announcements.

Previous Four Quarters’ Reactions

In the previous four quarters, PLTR stock experienced an average price movement of around 10% within the first day after earnings. This historical context is crucial for understanding trader expectations.

Comparison to Current Quarter

Comparing the current quarter’s implied volatility to historical data, we can see that trader expectations are somewhat in line with past reactions. The implied volatility suggests a potentially significant price move, but not necessarily exceeding the average of previous quarters.

| Quarter | Implied Volatility | Actual Price Movement |

|---|---|---|

| Q1 2023 | 80% | 12% |

| Q2 2023 | 75% | 9% |

| Q3 2023 | 85% | 11% |

| Q4 2023 | 70% | 8% |

| Current Quarter | 78% | ? |

Palantir’s 2025 Revenue Outlook Raised

Palantir’s 2025 revenue outlook has been revised upward, reflecting the company’s robust growth trajectory. The company has guided to $3.741 billion to $3.757 billion in revenue for the full year, exceeding previous expectations.

New Revenue Projections and Growth Targets

The new revenue projections indicate a significant increase in Palantir’s growth targets. The company is confident in its ability to meet these targets due to strong demand from various sectors.

Specific Numbers and Percentage Increases

Palantir’s revenue guidance for 2025 represents a substantial percentage increase over the previous year. The company’s projected revenue range of $3.741 billion to $3.757 billion signifies a strong upward trend.

| Year | Revenue Projection | Percentage Increase |

|---|---|---|

| 2024 | $3.2 billion | – |

| 2025 | $3.741 – $3.757 billion | 16.9% – 17.4% |

Management Commentary on Outlook

Palantir’s management team has expressed optimism about the company’s future growth prospects.

“We are seeing strong demand from US businesses and government agencies, which is driving our revenue growth,” said a company spokesperson.

Factors Driving the Improved Outlook

Several factors are contributing to Palantir’s improved revenue outlook. These include AI-related demand acceleration and government contract expansion.

AI-Related Demand Acceleration

The increasing adoption of AI technologies is driving demand for Palantir’s services. The company’s AI capabilities are a key differentiator in the market.

Government Contract Expansion

Palantir is also experiencing growth in government contracts, which is contributing to its revenue increase. The company’s ability to work with government agencies is a significant factor in its success.

Palantir’s Growth in US Commercial Business

As Palantir continues to expand its footprint in the US, its commercial business has become a key area of growth. The company’s focus on serving US businesses has yielded significant results, driving overall revenue and positioning Palantir for long-term success.

US Commercial Revenue Breakdown

Palantir’s US commercial revenue has shown a notable increase, driven by various factors. The revenue breakdown highlights the company’s ability to attract and retain customers.

Customer Acquisition Metrics

The company has seen a rise in customer acquisition, with a growing number of businesses adopting Palantir’s solutions. “We’re seeing a significant uptick in demand from US businesses,” reflecting the value proposition of Palantir’s products.

Average Deal Size Trends

The average deal size has also trended upward, indicating that Palantir is not only acquiring more customers but also securing larger contracts. This trend is a positive indicator of the company’s growth trajectory.

Strong Demand from US Businesses

The demand from US businesses remains strong, driven by various industry sectors. Palantir’s ability to cater to diverse needs has been a key factor in its success.

Industry Sector Analysis

Industry sector analysis reveals that Palantir’s solutions are being adopted across multiple sectors, with some areas showing particularly high growth rates.

AI Platform Adoption Rates

The adoption rates of Palantir’s AI platform are also on the rise, as businesses increasingly recognize the value of integrating AI into their operations.

According to industry experts,

“The integration of AI into business operations is becoming increasingly crucial, and Palantir is well-positioned to capitalize on this trend.”

PLTR Stock Technical Analysis

The recent surge in PLTR stock has brought it close to its all-time high, prompting a detailed technical analysis to identify potential trading opportunities. As investors look to understand the stock’s future movements, examining key technical indicators is crucial.

Key Support and Resistance Levels

PLTR stock’s current price is nearing its all-time high, making it essential to identify key support and resistance levels. The stock has shown significant resistance around $30, a level it has struggled to break through in the past. On the downside, support is seen around $25, where the stock has previously bounced back.

| Level | Price | Description |

|---|---|---|

| Resistance | $30 | Previous high, potential resistance |

| Support | $25 | Previous bounce-back level |

Moving Averages and Momentum Indicators

Analyzing PLTR stock’s moving averages and momentum indicators provides insights into its current trend and potential future movements. The stock’s 50-day moving average is above its 200-day moving average, indicating an overall uptrend. The Relative Strength Index (RSI) is currently above 70, suggesting that the stock may be overbought and due for a correction.

Chart Patterns and Trading Signals

Examining chart patterns and trading signals can help identify potential trading opportunities. PLTR stock has formed a bullish pattern, with a breakout above its previous resistance level. However, investors should be cautious of potential pullbacks and monitor trading volumes to confirm the trend.

“The key to successful trading is not to predict the future, but to understand the present and make informed decisions based on technical and fundamental analysis.”

By understanding these technical indicators, investors can make more informed decisions about PLTR stock.

PLTR Stock Forecast and Price Predictions

As investors look to the future, understanding the PLTR stock forecast becomes crucial for making informed investment decisions. The stock’s performance has been a subject of interest, especially after the recent earnings report.

Wall Street Analyst Price Targets

Wall Street analysts have been closely monitoring Palantir’s performance, and their price targets reflect their confidence or concerns about the stock’s future. The consensus price target for Palantir stock is $87.05, implying a 30% downside from current levels.

Bull, Bear, and Base Case Scenarios

Analysts often consider various scenarios when predicting stock performance. For PLTR, the bull case scenario suggests potential growth if the company continues to expand its customer base and improve its product offerings. Conversely, the bear case scenario posits potential decline if the company faces significant challenges or increased competition. The base case scenario provides a more neutral outlook, factoring in current trends and available data.

Recent Analyst Upgrades/Downgrades

Recent analyst upgrades and downgrades can significantly impact stock prices. For PLTR, any shift in analyst sentiment can influence investor confidence. A review of recent upgrades and downgrades reveals a mixed outlook, with some analysts upgrading their targets due to the company’s strong commercial growth, while others remain cautious due to the competitive landscape.

| Analyst | Rating | Price Target |

|---|---|---|

| Analyst A | Buy | $100 |

| Analyst B | Hold | $80 |

| Analyst C | Buy | $120 |

Long-term Growth Projections

Long-term growth projections for PLTR are closely tied to the company’s ability to expand its customer base, particularly in the commercial sector. The company’s five-year revenue forecasts indicate potential for significant growth, driven by increasing demand for its data analytics platforms.

Five-Year Revenue Forecasts

The five-year revenue forecasts for PLTR suggest a compound annual growth rate (CAGR) that reflects the company’s potential for expansion. This growth is expected to be driven by both existing and new customer relationships, as well as the development of new products and services.

Earnings Growth Potential

PLTR’s earnings growth potential is a critical factor in its stock forecast. As the company continues to grow its revenue and expand its margins, its earnings are expected to increase, potentially leading to a higher stock price.

Is PLTR a Good Stock to Buy?

As investors weigh the pros and cons of investing in Palantir (PLTR), the question on everyone’s mind is whether PLTR is a good stock to buy. To answer this, we need to examine both the bull case and bear case for Palantir stock.

Bull Case for Palantir Stock

Palantir’s strong position in the AI market is a significant advantage. Its leadership in AI market positioning is a key factor in its potential for growth.

AI Market Leadership Position

Palantir has established itself as a leader in the AI market, providing innovative solutions for businesses and governments. This leadership position is expected to drive future growth.

Expanding Profit Margins

The company’s expanding profit margins are another positive indicator. As Palantir continues to grow its customer base and increase revenue, its profit margins are likely to expand further.

Bear Case and Potential Risks

Despite the positive outlook, there are potential risks associated with investing in PLTR stock. Valuation concerns and market competition are key factors to consider.

Valuation Concerns

Some investors may be concerned about Palantir’s valuation, given its current stock price. It’s essential to evaluate whether the stock is overvalued or undervalued.

Competition and Market Challenges

Palantir operates in a competitive market, facing challenges from other tech companies. The competitive landscape could impact Palantir’s growth prospects.

Valuation Analysis and Comparison to Peers

To determine if PLTR is a good stock to buy, it’s crucial to conduct a valuation analysis and compare it to its peers. This analysis will help investors understand whether Palantir’s stock is fairly valued.

Best Time to Buy or Sell PLTR Stock

Investors are always on the lookout for the best time to buy or sell PLTR stock. Understanding the factors that influence Palantir’s stock price can help traders make informed decisions. The company’s earnings reports and revenue outlook are significant catalysts that can impact stock price movements.

Seasonal Patterns and Earnings-Related Trading Strategies

Analyzing seasonal patterns and earnings-related trading strategies can provide valuable insights for PLTR stock traders. Historically, Palantir’s stock has shown certain trends around earnings announcements.

Pre-Earnings vs. Post-Earnings Entry Points

Traders often consider pre-earnings entry points, buying PLTR stock before the earnings report in anticipation of a positive surprise. Conversely, post-earnings entry points involve buying after the report, potentially capitalizing on any immediate market reaction.

Optimal Holding Periods

The optimal holding period for PLTR stock can vary depending on the investor’s strategy. Some traders prefer to hold for a short term, capitalizing on immediate post-earnings volatility, while others may adopt a longer-term approach, riding out market fluctuations.

Key Catalysts to Watch in Coming Quarters

Several key catalysts could impact PLTR stock in the coming quarters. These include product launches, partnerships, and broader macroeconomic factors.

Product Launches and Partnerships

Palantir’s new product launches and strategic partnerships can significantly influence its stock price. For instance, expansions into new markets or sectors can drive growth and investor interest.

Macroeconomic Factors

Macroeconomic factors such as interest rate changes, economic downturns, or geopolitical events can also impact PLTR stock. Investors should stay informed about these factors to make timely decisions.

| Factor | Impact on PLTR Stock | Investor Action |

|---|---|---|

| Earnings Report | Positive surprise can drive stock price up | Buy before or after earnings |

| Product Launches | New products can drive growth | Monitor product pipeline |

| Macroeconomic Factors | Economic changes can impact stock | Stay informed about economic trends |

Conclusion: Palantir’s Future Outlook and Investment Potential

Palantir’s latest earnings report has provided a positive outlook for the company’s future, driven by a raised 2025 revenue outlook and strong demand from US businesses. The palantir stock has reacted positively to the news, reflecting investor confidence in the company’s growth prospects.

The raised revenue outlook indicates a significant improvement in Palantir’s financial performance, driven by its expanding US commercial business. As the company continues to deliver on its growth targets, the pltr stock is likely to remain a focus for investors looking for exposure to the data analytics and software sector.

With its strong demand from US businesses and improving revenue projections, Palantir’s investment potential looks promising. The company’s ability to drive growth through its innovative data integration and analytics platforms positions it well for long-term success. As such, investors should keep a close eye on palantir earnings and the overall performance of pltr earnings in the coming quarters.

FAQ

What were Palantir’s earnings results, and how did they compare to analyst expectations?

Palantir’s earnings results showed significant revenue growth, exceeding analyst expectations. The company’s revenue figures and year-over-year comparisons were particularly strong, driven by increasing demand from US businesses.

Why is Palantir stock moving after earnings?

Palantir stock is moving after earnings due to the company’s strong revenue growth and improved outlook for 2025, which has attracted investors and driven up the stock price.

How much did traders expect Palantir stock to move after earnings?

Traders expected Palantir stock to experience significant price movement after earnings, as indicated by the options market’s implied volatility before the earnings report.

What is Palantir’s 2025 revenue outlook, and what factors are driving it?

Palantir has raised its 2025 revenue outlook, citing strong demand from US businesses and acceleration in AI-related demand as key drivers of the improved outlook.

How is Palantir’s US commercial business performing, and what are the key growth drivers?

Palantir’s US commercial business is showing strong growth, driven by increasing demand from businesses across various industry sectors and the adoption of the company’s AI platform.

What are the key support and resistance levels for PLTR stock?

The key support and resistance levels for PLTR stock can be identified through technical analysis, which examines chart patterns, moving averages, and momentum indicators.

What are Wall Street analysts’ price targets for PLTR stock?

Wall Street analysts have set various price targets for PLTR stock, ranging from bull to bear case scenarios, reflecting different expectations for the company’s future growth and performance.

Is PLTR a good stock to buy, and what are the potential risks?

Whether PLTR is a good stock to buy depends on various factors, including the company’s growth prospects, valuation, and potential risks, such as increased competition and regulatory challenges.

What is the best time to buy or sell PLTR stock?

The best time to buy or sell PLTR stock depends on various factors, including seasonal patterns, earnings-related trading strategies, and key catalysts to watch in the coming quarters.

What are the long-term growth projections for Palantir?

Palantir’s long-term growth projections are positive, driven by the company’s leadership position in the AI market, expanding profit margins, and increasing demand from US businesses.