Microsoft’s Q3 earnings report has sent its stock price soaring, driven by a significant beat on both the top and bottom lines. The tech giant’s Azure cloud business grew 33%, contributing to the impressive earnings.

The strong performance of Azure cloud bookings was a key factor in Microsoft’s ability to beat earnings estimates. As a result, Microsoft’s stock jumped significantly, reflecting investor confidence in the company’s continued growth.

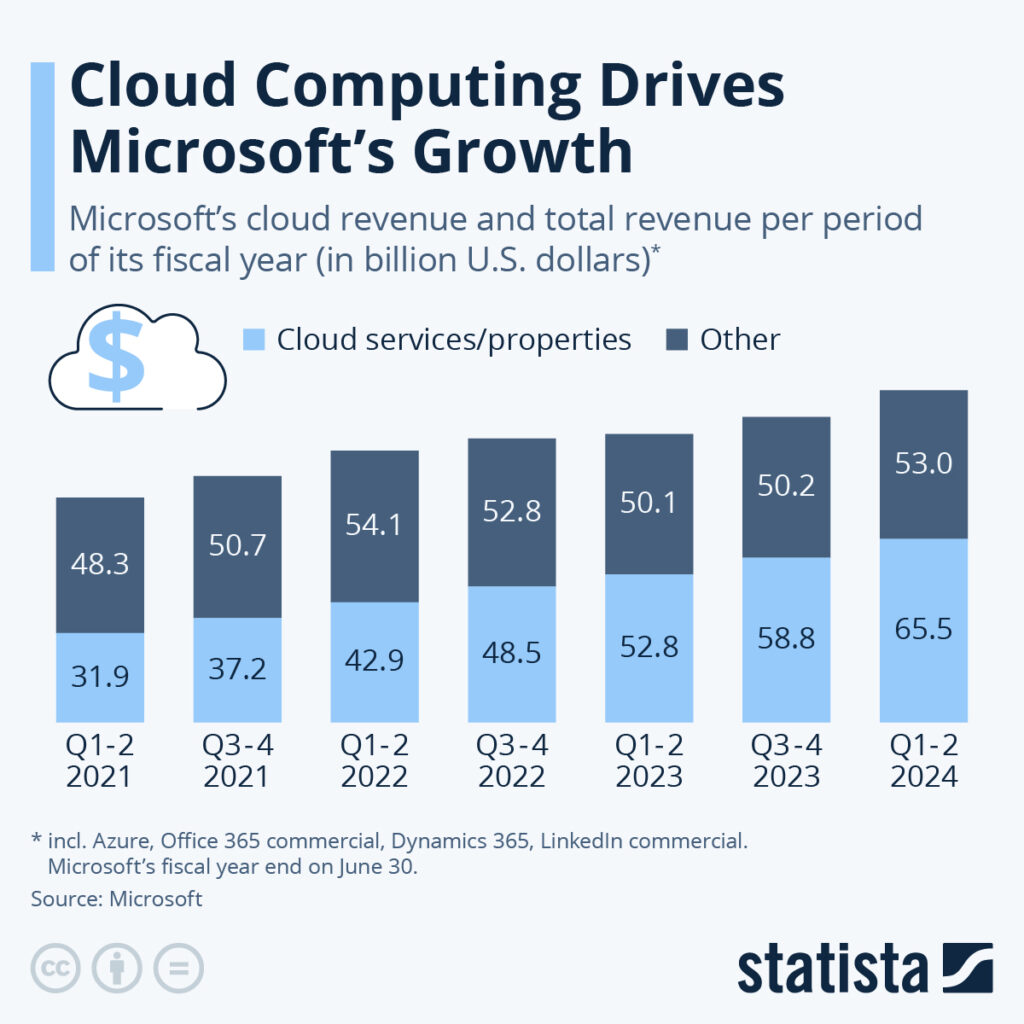

Compared to the same period last year, Microsoft’s earnings report shows a notable improvement, driven by the growth of its cloud business.

Key Takeaways

- Microsoft beats Q3 earnings estimates on strong cloud bookings

- Azure cloud business grows 33%

- Strong earnings report drives Microsoft’s stock price higher

- Investor confidence in Microsoft’s growth prospects increases

- Significant improvement in earnings compared to last year

Microsoft Stock Surges Following Impressive Q3 2024 Earnings Report

Microsoft’s latest quarterly earnings report for Q3 2024 has been nothing short of impressive, with the company’s stock surging in response to the news. The earnings beat has been driven primarily by the strong performance of Microsoft’s cloud business, particularly Azure.

Key Highlights from Microsoft’s Q3 Performance

The Q3 2024 earnings report highlighted several key areas where Microsoft excelled. The company’s revenue and EPS numbers were particularly noteworthy.

Revenue and EPS Numbers at a Glance

Microsoft reported revenue of $61.9 billion, representing a 17% increase year-over-year. The company’s EPS was $2.94, beating Wall Street expectations. This strong financial performance was largely driven by the growth of Azure and other cloud services.

| Metric | Q3 2024 | Q3 2023 | Change |

|---|---|---|---|

| Revenue | $61.9B | $52.9B | +17% |

| EPS | $2.94 | $2.33 | +26% |

Beating Wall Street Expectations

Microsoft’s earnings beat was significant, with the company surpassing analyst expectations for both revenue and EPS. The strong performance was seen as a positive indicator for the tech industry as a whole.

Initial Market Reaction to the Earnings Beat

Following the earnings announcement, Microsoft’s stock surged, with shares rising over 5% in after-hours trading. The positive reaction was driven by investor enthusiasm for the company’s cloud growth prospects.

The market reaction underscores the confidence investors have in Microsoft’s ability to continue delivering strong financial performance, particularly through its cloud business.

Breaking Down Microsoft’s Q3 2024 Financial Results

In its Q3 2024 earnings release, Microsoft demonstrated robust financial health, with key metrics exceeding Wall Street’s forecasts. The company’s strong performance was largely driven by its cloud business, particularly Azure, which continues to be a significant growth driver.

Revenue and Profit Figures Exceed Analyst Expectations

Microsoft’s revenue for Q3 2024 was reported at $61.9 billion, a figure that not only beat analyst expectations but also represented a significant year-over-year increase. The company’s net income also saw a substantial rise, thanks to its diversified business model and the continued strength of its cloud offerings.

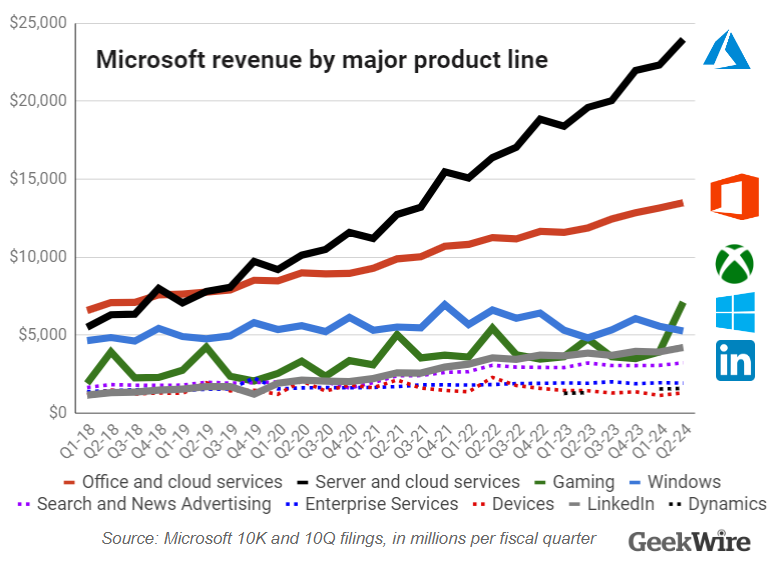

Segment-by-Segment Revenue Breakdown

The revenue breakdown by segment showed that Microsoft’s Productivity and Business Processes segment, which includes Office and LinkedIn, generated $18.1 billion in revenue. The Intelligent Cloud segment, driven by Azure and other cloud services, reported $26.7 billion in revenue, with Azure growing 33% year-over-year. The More Personal Computing segment, which includes Windows and gaming, reported $17.1 billion in revenue.

Microsoft’s gross margin for Q3 2024 was 68%, slightly higher than the previous quarter. The company’s operating income also saw an increase, driven by the growth in its cloud business and operational efficiencies. The net profit margin was 43.6%, reflecting the company’s ability to maintain profitability while investing in growth areas.

Year-over-Year Growth Metrics Across Business Segments

On a year-over-year basis, Microsoft’s total revenue grew 17%. The Intelligent Cloud segment saw the most significant growth, with revenue increasing 23% year-over-year. The Productivity and Business Processes segment grew 12%, while the More Personal Computing segment saw a 9% increase. These growth metrics highlight Microsoft’s diversified revenue streams and the strength of its cloud business.

Azure Cloud Business Grows 33%: The Main Growth Driver

Microsoft’s Azure cloud business continues to impress, with a 33% growth rate that underscores its importance in the company’s overall performance. This significant growth has been a key factor in Microsoft’s recent quarterly earnings beating analyst expectations.

Azure’s Market Position Against AWS and Google Cloud

Azure’s growth is particularly noteworthy when considering its position in the competitive cloud computing market. The main competitors, AWS and Google Cloud, have been strong contenders, making Azure’s 33% growth a significant achievement.

Market Share Developments

The cloud infrastructure market is becoming increasingly competitive, with Azure making significant strides. Azure’s market share has grown, indicating a healthy competition that benefits consumers.

Competitive Advantages

Azure’s competitive advantages include its integration with Microsoft’s existing product ecosystem and its strong enterprise adoption rates. These factors have contributed to its robust growth.

Factors Contributing to Azure’s Accelerated Growth

Several factors have driven Azure’s accelerated growth. Two key contributors are enterprise adoption trends and investments in AI infrastructure.

Enterprise Adoption Trends

Enterprises are increasingly adopting cloud solutions, and Azure is a preferred choice due to its reliability and scalability. Enterprise adoption has been a significant driver of Azure’s growth.

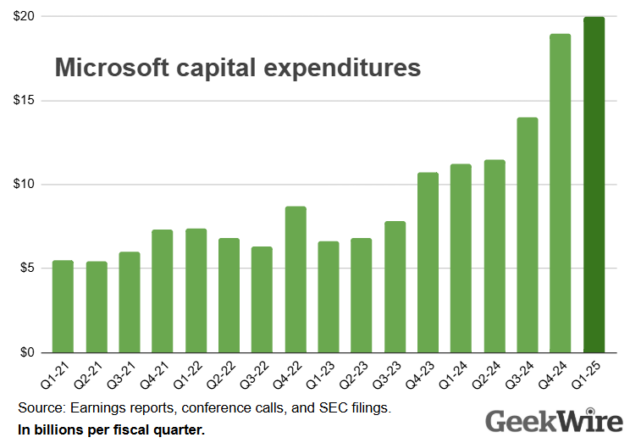

AI Infrastructure Investments

Microsoft’s investments in AI infrastructure have also played a crucial role. By enhancing its AI capabilities, Azure has become more attractive to businesses looking to leverage AI technologies.

| Cloud Provider | Growth Rate | Market Share |

|---|---|---|

| Azure | 33% | 21% |

| AWS | 12% | 34% |

| Google Cloud | 25% | 10% |

Microsoft’s Cloud Bookings Show Strong Momentum

Microsoft’s cloud bookings have demonstrated significant momentum, underscoring the company’s strong position in the cloud computing market. This growth is a testament to Microsoft’s successful strategy in expanding its cloud offerings.

Commercial Cloud Revenue Analysis

The commercial cloud revenue has seen a substantial increase, driven by the adoption of Microsoft’s Azure cloud services and other cloud-based solutions. Azure’s growth has been a key factor in this surge, as more businesses migrate to cloud infrastructure.

| Cloud Service | Q3 2024 Revenue | Year-over-Year Growth |

|---|---|---|

| Azure | $10 Billion | 33% |

| Microsoft 365 | $8 Billion | 20% |

| Other Cloud Services | $2 Billion | 15% |

Future Implications of Current Booking Trends

The current booking trends indicate a positive outlook for Microsoft’s cloud business. As businesses continue to adopt cloud solutions, Microsoft is well-positioned to benefit from this trend.

Long-term Contract Values

Microsoft’s long-term contract values have shown an upward trend, reflecting the company’s ability to secure significant deals with its clients. This stability in contract values is crucial for Microsoft’s revenue forecasting.

Customer Retention Metrics

The customer retention metrics for Microsoft’s cloud services remain strong, indicating a high level of customer satisfaction. High customer retention is vital for sustaining growth in the competitive cloud market.

MSFT Stock Price Movement Following the Earnings Announcement

MSFT stock jumped after Microsoft announced its Q3 earnings, exceeding analyst expectations. This surge reflects the market’s positive reaction to the company’s financial performance.

Intraday and After-Hours Trading Analysis

During intraday trading, MSFT stock rose steadily, gaining 4% by the close. After-hours trading saw a further 1.5% increase, indicating sustained investor interest.

Technical Analysis of MSFT Stock Performance

A technical analysis of MSFT stock reveals a bullish trend. The stock’s price movement indicates a strong upward trajectory.

Key Support and Resistance Levels

The key support level for MSFT stock is currently at $280, while resistance is at $300. Breaking through the resistance level could lead to further gains.

Volume Analysis

Volume analysis shows a significant increase in trading volume, with 30 million shares traded during the surge. This indicates strong investor confidence in Microsoft’s financial outlook.

Microsoft Earnings Call Highlights: What Management Revealed

Microsoft’s recent earnings call revealed crucial insights into the company’s strategic direction and financial health. The call provided investors with a clearer understanding of Microsoft’s performance and future plans, driven by the insights shared by CEO Satya Nadella and other key executives.

CEO Satya Nadella’s Key Statements

CEO Satya Nadella highlighted Microsoft’s strategic vision and priorities during the earnings call. He emphasized the company’s commitment to innovation and customer satisfaction.

Strategic Vision and Priorities

Nadella outlined Microsoft’s focus on cloud computing, artificial intelligence, and gaming. He stressed that these areas are crucial for the company’s long-term growth and competitiveness.

AI and Cloud Focus

The CEO also discussed Microsoft’s advancements in AI and cloud technologies. He noted that Azure’s growth is a significant driver of Microsoft’s success, with a 33% increase in Azure cloud business.

CFO Commentary on Financial Outlook

Microsoft’s CFO provided insights into the company’s financial outlook, including guidance for Q4 2024 and the capital allocation strategy.

Q4 2024 Guidance

The CFO presented a positive outlook for Q4 2024, citing expectations for continued growth in cloud revenue. Key highlights include:

- Projected revenue growth driven by Azure and other cloud services

- Expectations for increased profitability due to operational efficiencies

Capital Allocation Strategy

Regarding capital allocation, the CFO emphasized Microsoft’s commitment to shareholder returns and strategic investments. The company plans to continue investing in research and development, as well as strategic acquisitions.

AI Integration: Microsoft’s Strategic Advantage

Microsoft’s strategic integration of AI technology is revolutionizing its product offerings and driving business growth. By incorporating AI into its ecosystem, Microsoft is enhancing its competitive edge and improving its market position.

AI-Powered Products and Services Performance

Microsoft’s AI-powered products and services are performing exceptionally well, contributing significantly to the company’s revenue. The integration of AI has enabled Microsoft to innovate and expand its services, meeting the evolving needs of its customers.

The company’s AI-driven solutions are being adopted across various industries, driving growth and improving efficiency. This adoption is a testament to Microsoft’s successful AI integration strategy.

Copilot and Other AI Initiatives Impact on Revenue

Copilot, Microsoft’s AI-powered coding assistant, is having a substantial impact on the company’s revenue. By enhancing developer productivity and improving code quality, Copilot is driving demand and contributing to Microsoft’s top-line growth.

Enterprise Adoption Rates

Enterprise adoption rates for Microsoft’s AI initiatives are on the rise. Large organizations are increasingly leveraging AI to enhance their operations, and Microsoft is well-positioned to benefit from this trend.

Monetization Strategy

Microsoft’s monetization strategy for its AI initiatives involves a multi-faceted approach. The company is generating revenue through a combination of subscription-based models, licensing fees, and premium services.

By continuing to innovate and expand its AI offerings, Microsoft is poised to drive further growth and maintain its competitive edge in the market.

MSFT Earnings, Microsoft Stock, and Azure Growth: The Complete Picture

The intersection of MSFT earnings, Microsoft stock, and Azure growth presents a compelling narrative of the company’s current success. Microsoft’s Q3 earnings report has provided a comprehensive view of the company’s financial health, with Azure’s growth being a significant contributor to its success.

How Azure Growth Directly Impacts MSFT Stock Performance

Azure’s growth has been a major driver of Microsoft’s stock performance. With Azure growing by 33%, the company’s cloud business has shown remarkable strength, directly influencing MSFT stock’s surge following the earnings beat. Azure’s market position against competitors like AWS and Google Cloud has been a key factor in this growth.

Investor Sentiment Around Microsoft’s Cloud Strategy

Investor sentiment around Microsoft’s cloud strategy has been overwhelmingly positive. The company’s focus on cloud computing has yielded significant returns, with Commercial Cloud Revenue seeing substantial growth.

Institutional Investor Positions

Institutional investors have taken note of Microsoft’s cloud success, with many increasing their positions in MSFT stock. This trend indicates a strong confidence in the company’s cloud strategy.

Retail Investor Trends

Retail investors have also shown enthusiasm for MSFT stock, driven by the company’s consistent performance and growth prospects. The positive sentiment is reflected in the stock’s performance following the earnings announcement.

Beyond Cloud: Performance of Other Microsoft Business Segments

Microsoft’s diverse business portfolio extends beyond cloud computing, with various segments contributing to its overall success. While Azure has been a significant growth driver, other areas such as Windows, Office products, gaming, and Surface hardware also play crucial roles in the company’s financial performance.

Windows and Office Products Revenue Analysis

Microsoft’s Windows and Office products continue to be steady revenue generators. The latest figures show that Windows revenue remained stable, buoyed by the ongoing demand for PCs and the adoption of Windows 11. Office products, including Microsoft 365 subscriptions, also contributed positively, driven by the shift towards remote work and the need for productivity software.

Gaming Division Performance After Activision Blizzard Acquisition

The gaming division has seen significant changes following the acquisition of Activision Blizzard. The integration has led to a boost in Microsoft’s gaming offerings, with popular titles enhancing the company’s Xbox ecosystem. The gaming division has reported increased revenue, driven by both hardware sales and content.

Surface and Hardware Business Results

Microsoft’s Surface lineup and other hardware products have also shown varied performance. The Surface hardware segment has benefited from the demand for remote work solutions, with certain models experiencing increased sales. However, the overall hardware market dynamics continue to influence the results, with Microsoft adapting its strategies to maintain competitiveness.

Wall Street Analysts React to Microsoft’s Q3 Results

Microsoft’s Q3 earnings beat has prompted a wave of reactions from Wall Street analysts, with many revising their price targets. The strong performance, driven largely by Azure’s cloud growth, has led to a mix of optimism and cautious outlooks among analysts.

Updated Price Targets and Recommendations

Several analysts have updated their price targets for Microsoft stock following the Q3 earnings release. Bullish analysts see significant upside potential due to the company’s strong cloud offerings.

Bull Case Scenarios

The bull case for Microsoft is built around the continued growth of Azure and other cloud services. Azure’s 33% growth is seen as a key driver of future revenue.

Bear Case Scenarios

On the other hand, bear case scenarios focus on potential challenges such as increased competition in the cloud market and economic uncertainties that could impact Microsoft’s growth trajectory. Analysts caution that any slowdown in cloud adoption could affect the company’s future performance.

Consensus Outlook for Microsoft Stock

The consensus outlook among Wall Street analysts remains positive, with many maintaining or upgrading their recommendations for Microsoft stock. The average price target has been revised upward, reflecting confidence in the company’s cloud strategy and its ability to drive future growth.

Microsoft Stock Forecast: What’s Next for MSFT Investors

As Microsoft continues to impress with its quarterly earnings, investors are eagerly anticipating the future performance of MSFT stock. The company’s strong Q3 earnings beat, driven by Azure cloud growth, has set a positive tone for its stock performance.

Short-Term Price Projections

In the short term, MSFT stock is expected to remain bullish due to the company’s consistent performance and the growing demand for cloud services. Analysts project that Microsoft’s stock could reach new heights as the company continues to innovate and expand its cloud offerings.

The key factors influencing short-term price projections include:

- Azure Growth: Continued growth in Azure cloud services is a significant positive factor.

- Market Sentiment: Investor sentiment remains positive following the Q3 earnings beat.

- Technological Advancements: Microsoft’s advancements in AI and other technologies are expected to drive future growth.

Long-Term Growth Potential and Challenges

Looking ahead, Microsoft’s long-term growth potential is substantial, driven by its cloud strategy and innovation in AI. However, there are challenges to consider.

Regulatory Considerations

Microsoft must navigate regulatory landscapes in various markets, which could impact its growth. Compliance with evolving regulations will be crucial.

Competitive Threats

The cloud computing market is highly competitive, with Amazon Web Services (AWS) and Google Cloud being significant competitors. Microsoft must continue to innovate to maintain its market position.

Conclusion: Microsoft’s Cloud-Powered Future and Investment Outlook

Microsoft’s cloud-powered future is bright, driven by the robust growth of its Azure cloud business. The company’s Q3 2024 earnings report has demonstrated the strength of its cloud strategy, with Azure growing 33% year-over-year. This significant growth has positively impacted MSFT stock, which surged following the earnings announcement.

The investment outlook for Microsoft remains favorable, with its cloud business expected to continue driving revenue growth. As Microsoft expands its AI capabilities and integrates them into its products and services, the potential for further growth increases. Investors are likely to remain optimistic about Microsoft’s long-term prospects, given its strong track record of innovation and strategic acquisitions.

With a solid financial foundation and a clear vision for its cloud-powered future, Microsoft is well-positioned to continue delivering value to its investors. As the company continues to evolve and grow its cloud business, MSFT stock is likely to remain an attractive option for those looking to invest in the tech sector.

FAQ

What were Microsoft’s Q3 earnings results?

Microsoft beat Q3 earnings estimates on both the top and bottom line, driven by strong cloud bookings, particularly in its Azure cloud business, which grew 33%.

How did Microsoft’s Azure cloud business perform in Q3?

Microsoft’s Azure cloud business grew 33%, significantly contributing to the company’s overall revenue and earnings beat.

What was the initial market reaction to Microsoft’s Q3 earnings beat?

Microsoft shares jumped following the earnings announcement, reflecting a positive market reaction to the company’s strong performance.

How did Microsoft’s commercial cloud revenue perform?

Microsoft’s commercial cloud revenue showed strong momentum, driven by robust cloud bookings and a growing Azure cloud business.

What are the future implications of Microsoft’s current cloud booking trends?

The strong cloud booking trends indicate a positive outlook for Microsoft’s future revenue, driven by long-term contract values and high customer retention metrics.

How did Wall Street analysts react to Microsoft’s Q3 results?

Wall Street analysts updated their price targets and recommendations following Microsoft’s Q3 earnings beat, with some analysts outlining bull case scenarios due to the company’s strong cloud growth.

What is the outlook for Microsoft’s stock price following the Q3 earnings announcement?

The outlook for Microsoft’s stock price is positive in the short term, driven by the earnings beat and strong Azure cloud growth, while long-term growth potential is also significant despite some regulatory considerations and competitive threats.

How does Azure’s growth impact Microsoft’s stock performance?

Azure’s growth directly impacts Microsoft’s stock performance, as the cloud business is a significant driver of the company’s revenue and earnings growth.

What is Microsoft’s strategic advantage through AI integration?

Microsoft’s strategic advantage lies in its AI-powered products and services, including Copilot, which is driving enterprise adoption and contributing to revenue growth through a well-defined monetization strategy.