Walt Disney Co. (NYSE: DIS) experienced a significant surge in its shares, rising 10.54% to close at $101.80 on May 7, following the release of its strong earnings report and notable growth in Disney+ subscribers.

The company’s earnings beat expectations, driven largely by the unexpected uptick in Disney+ subscriber growth, which contributed to the overall positive market reaction.

As a result, Disney’s stock saw a significant climb, reflecting investor confidence in the company’s continued growth potential.

Key Takeaways

- Disney’s shares rose 10.54% to $101.80 on May 7.

- Strong earnings and Disney+ growth drove the stock surge.

- The company’s earnings beat market expectations.

- Disney+ subscriber growth exceeded forecasts.

- Investor confidence in Disney’s growth potential increased.

Disney’s Q2 2025 Earnings Overview

In its Q2 2025 earnings release, Disney demonstrated robust financial performance, exceeding analyst expectations on both the top and bottom lines.

Disney reported adjusted earnings per share (EPS) of $1.45 on revenue of $23.62 billion. This significant achievement underscores the company’s ability to drive growth across its various business segments.

Key Financial Highlights

The key financial highlights of Disney’s Q2 2025 earnings include:

| Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Revenue | $23.62 billion | $22.08 billion |

| Adjusted EPS | $1.45 | $1.21 |

Beating Analyst Expectations

Disney’s earnings report beat analyst expectations, driven by strong performance across its business segments. The company’s ability to exceed expectations is a testament to its strategic initiatives and operational efficiency.

The positive earnings report is expected to have a favorable impact on Disney’s stock performance, reinforcing investor confidence in the company’s growth prospects.

Disney Stock Dis Stock Disney Lifts Profit Outlook After Delivering Solid Parks Performance

Disney’s shares jumped 10% after the company released its earnings, showcasing a strong recovery and growth in key business segments. This significant surge underscores the market’s positive reaction to Disney’s financial performance.

Stock Price Movement Following Earnings

The stock price movement following Disney’s earnings report was notably positive. The company’s shares not only surged 10% but also demonstrated a strong upward trend in the days following the report. This movement was largely driven by the company’s ability to exceed analyst expectations with its strong earnings.

Market Reaction Analysis

The market reaction to Disney’s earnings was overwhelmingly positive, with investors reacting favorably to the company’s solid parks performance and the growth in Disney+ subscribers. The increase in Disney’s stock price reflects confidence in the company’s ability to drive growth through its diverse business segments, including parks and streaming services.

Disney’s ability to lift its profit outlook after delivering solid parks revenue highlights the strength of its business model. The positive outlook is a testament to the company’s effective strategy in managing its various revenue streams, including parks, media, and entertainment distribution.

Breaking Down Disney’s Revenue Streams

Disney’s business is diversified across several revenue streams, contributing to its overall growth. The company’s financial performance is driven by multiple key business segments.

Parks and Experiences Segment

The Parks and Experiences segment has been a significant contributor to Disney’s revenue. Disney parks revenue saw a notable increase due to the strong performance of Disney’s theme parks and resorts. This growth was driven by increased visitor numbers and strategic pricing.

Media and Entertainment Distribution

Disney’s Media and Entertainment Distribution segment, which includes its streaming services, has also shown impressive growth. The success of Disney+ has been a major factor, with Disney streaming profits benefiting from better-than-expected subscriber growth.

International Operations

Disney’s International Operations segment has contributed to the company’s revenue growth, driven by strong performance in various global markets. The success of Disney international operations highlights the company’s ability to adapt to different regional markets.

Overall, Disney’s diversified revenue streams have positioned the company for continued growth and financial success.

Disney+ Subscriber Growth Exceeds Expectations

With a strong rebound in subscriber growth, Disney+ is proving to be a key driver of Disney’s overall success. The latest earnings report has revealed some impressive numbers that not only met but exceeded market expectations.

Subscriber Numbers and Growth Rate

Disney+ ended the quarter with 126.0 million paid users, a significant milestone that underscores the service’s popularity. Notably, the platform added 1.4 million new subscribers during the quarter, marking a robust rebound after previous concerns about subscriber loss.

| Quarter | Paid Subscribers (in millions) | Subscriber Growth (in millions) |

|---|---|---|

| Q1 2025 | 124.6 | 1.2 |

| Q2 2025 | 126.0 | 1.4 |

Content Strategy Driving Subscriptions

A key factor behind Disney+’s success is its content strategy. By continually adding popular and original content, Disney has managed to attract and retain subscribers. The inclusion of new Star Wars and Marvel series has been particularly effective in driving growth.

Addressing Previous Subscriber Challenges

Disney+ has faced challenges in the past, including increased competition from other streaming services. However, Disney’s strategic focus on improving its content offerings and user experience has helped to not only retain existing subscribers but also attract new ones.

The strong performance of Disney+ is a significant contributor to Disney’s overall streaming profits and positions the company favorably in the competitive streaming landscape.

Disney Parks Revenue: A Major Contributor to Growth

Disney’s Experiences segment has recorded a notable surge in operating income, highlighting the importance of its parks revenue. The segment recorded an operating income of $2.5 billion, representing a 9% increase compared to the previous year.

Domestic Parks Performance

The domestic parks performance remained healthy, driven by strong visitor numbers and strategic pricing. This stability in the domestic market has been a crucial factor in Disney’s overall revenue growth.

International Parks Expansion

International parks expansion has also significantly contributed to Disney’s growth. The company has been investing in enhancing the experiences offered at its international parks, attracting more visitors and increasing revenue.

Disney Abu Dhabi Theme Park Development

A key aspect of Disney’s international expansion is the development of the Disney Abu Dhabi theme park. This project represents a significant investment in the region and is expected to drive further growth in Disney’s international parks revenue.

Post-Pandemic Recovery Strategy

Disney’s post-pandemic recovery strategy for its parks segment has focused on adapting to changing consumer behaviors and preferences. By enhancing the guest experience and offering innovative services, Disney has been able to recover and grow its parks revenue beyond pre-pandemic levels.

The strong performance of Disney’s parks revenue underscores the company’s successful strategy in this segment. With continued investment in domestic and international parks, Disney is well-positioned for future growth.

Streaming Business Profitability Analysis

With a substantial increase in operating income, Disney’s streaming segment is on the path to profitability. Disney’s streaming platforms saw continued growth, with 180.7 million combined Disney+ and Hulu subscribers. This growth is a significant factor in the company’s efforts to achieve profitability in its streaming business.

Disney+ Path to Profitability

Disney+ has been a key driver of Disney’s streaming growth, with its subscriber base continuing to expand. The operating income of Disney’s streaming business increased from $47 million last year to $336 million this quarter, indicating a significant step towards profitability. As Disney+ continues to grow its subscriber base and optimize its content offerings, the path to profitability becomes more achievable.

According to Bob Iger, CEO of Disney, “We’re making significant progress in our streaming business, and we’re committed to continuing to invest in high-quality content that delights our subscribers.” This commitment to quality content is crucial in maintaining subscriber growth and driving profitability.

Hulu and ESPN+ Performance

Hulu and ESPN+ also play critical roles in Disney’s streaming strategy. Hulu continues to offer a robust linear TV experience alongside its on-demand offerings, while ESPN+ remains a leader in sports streaming. The combined strength of these platforms contributes to Disney’s overall streaming profitability.

| Platform | Subscribers (millions) | Key Features |

|---|---|---|

| Disney+ | 146.7 | Extensive library of Disney, Pixar, Marvel, and Star Wars content |

| Hulu | 34 | Linear TV and on-demand content, including TV shows and movies |

| ESPN+ | Not specified | Exclusive sports content, including live events and original programming |

Streaming Bundle Strategy

Disney’s streaming bundle strategy, which combines Disney+, Hulu, and ESPN+, offers consumers a comprehensive entertainment package. This strategy not only enhances the value proposition for subscribers but also increases the average revenue per user (ARPU). By bundling these services, Disney aims to improve customer retention and attract new subscribers.

The success of this strategy is evident in the growing subscriber numbers and the increasing operating income from the streaming segment. As Disney continues to refine its streaming offerings and expand its content library, the potential for further growth in profitability is significant.

Disney’s Updated Fiscal 2025 Guidance

In its latest earnings report, Disney announced an upward revision of its fiscal 2025 guidance, driven by robust growth across all segments. The company now expects adjusted EPS of $5.75 in fiscal 2025, representing a 16% increase from the previous year.

Revenue Projections

Disney’s revenue projections for fiscal 2025 have been revised upward, reflecting strong performance in its parks and experiences segment, as well as significant growth in its media and entertainment distribution business. The company’s diversified revenue streams are expected to drive continued growth throughout the year.

Profit Margin Expectations

The company has also updated its profit margin expectations for fiscal 2025. With a focus on operational efficiency and cost management, Disney is poised to achieve higher profit margins across its business segments. As stated by Disney’s CEO,

“We are confident in our ability to deliver long-term value to our shareholders through our strategic initiatives and operational excellence.”

Capital Allocation Strategy

Disney’s capital allocation strategy remains focused on investing in high-growth areas, such as streaming and international expansion, while also returning value to shareholders through dividends and share repurchases. The company’s strong financial position and cash flow generation capabilities provide flexibility to pursue strategic opportunities.

Disney+ vs. Netflix: Competitive Landscape Analysis

With Disney+ adding 1.4 million new subscribers, the competition between Disney+ and Netflix is heating up. Disney+ ended the quarter with 126.0 million paid users, a significant number, although Netflix still maintains a larger subscriber base.

Subscriber Growth Comparison

The subscriber growth of Disney+ has been impressive, beating analyst expectations. This growth is a testament to Disney’s effective content strategy and its ability to attract new subscribers. In contrast, Netflix, while still a leader, has seen varying growth rates.

Key statistics: Disney+ added 1.4 million subscribers, reaching 126.0 million paid users.

Content Investment Strategies

Disney+ has focused on investing in high-quality content, including exclusive Disney, Pixar, Marvel, and Star Wars titles. This strategy has been crucial in attracting and retaining subscribers. Netflix, on the other hand, has diversified its content offerings, including original productions and licensed content.

Content investment is a critical factor in the streaming industry, driving subscriber growth and retention.

Pricing and Profitability Models

The pricing strategies of Disney+ and Netflix differ, with Disney+ offering competitive pricing and bundle options, such as the Disney+ bundle with Hulu and ESPN+. Netflix, however, has focused on price hikes to improve profitability. The profitability models of both services are influenced by their content costs, pricing, and subscriber numbers.

- Disney+ offers competitive pricing and bundle options.

- Netflix has implemented price hikes to boost profitability.

As the streaming landscape continues to evolve, the competition between Disney+ and Netflix will remain a key area of focus.

Disney’s Strategic Initiatives Driving Growth

Disney is implementing various strategic measures to enhance its growth prospects. With a focus on innovation and efficiency, the company is poised to capitalize on emerging opportunities in the entertainment industry.

Content Creation and IP Leverage

Disney’s content creation strategy is centered around leveraging its vast intellectual property (IP) portfolio. By producing high-quality content across various platforms, Disney aims to attract and retain subscribers. The company’s IP leverage strategy includes:

- Developing new content based on beloved franchises

- Expanding its streaming library with exclusive titles

- Enhancing its production capabilities through technological advancements

Digital Transformation Efforts

Disney is undergoing significant digital transformation efforts to stay competitive. This includes:

- Investing in cutting-edge technology to enhance user experience

- Implementing data analytics to inform content decisions

- Expanding its digital presence across various platforms

These efforts are designed to drive engagement and increase revenue streams.

Cost-Cutting Measures

In addition to driving growth through content and digital transformation, Disney is also focusing on cost-cutting measures. By streamlining operations and reducing unnecessary expenses, the company aims to improve its profit margins and maintain a competitive edge in the market.

Overall, Disney’s strategic initiatives are designed to drive long-term growth and profitability. By focusing on content creation, digital transformation, and cost efficiency, the company is well-positioned for success in the evolving entertainment landscape.

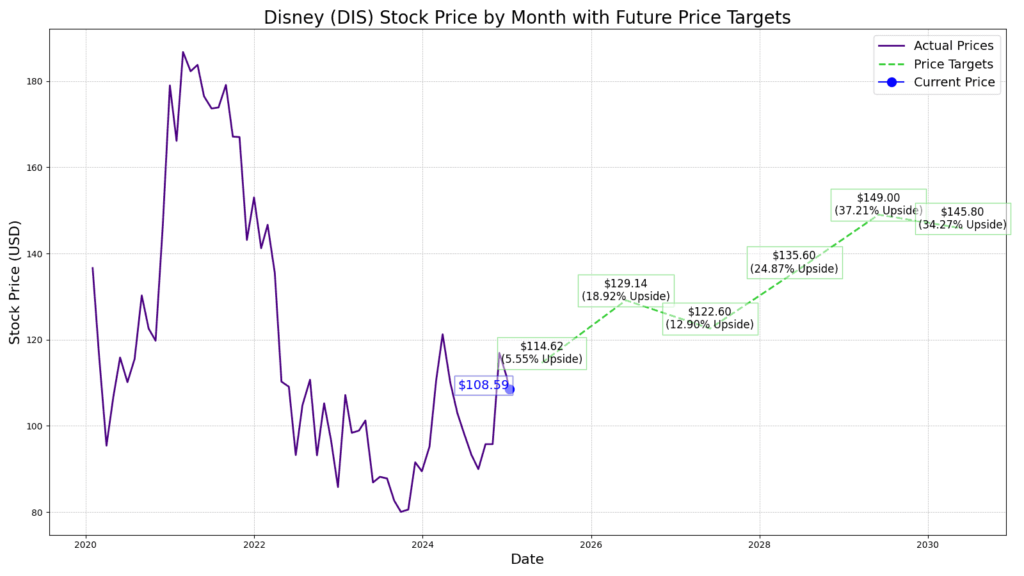

Analyst Perspectives on Disney Stock

The recent earnings report from Disney has prompted a fresh wave of analysis from industry experts. Analysts have varying perspectives on Disney stock, with some rating it a buy and others a hold.

Wall Street Ratings and Price Targets

Several analysts have updated their ratings and price targets for Disney stock following the earnings report.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Goldman Sachs | Buy | $120 |

| Bank of America | Hold | $110 |

| Morgan Stanley | Buy | $130 |

Bull vs. Bear Arguments

The bull case for Disney stock is centered around its strong earnings growth and the potential for continued success in its streaming business. On the other hand, bear arguments focus on the competitive landscape and potential challenges in maintaining growth momentum.

Consensus Recommendations

Despite varying opinions, the consensus among analysts is that Disney stock is a buy, driven by its robust financial performance and growth prospects.

Is Disney a Good Stock to Buy Now? Investment Analysis

Disney’s stock has seen a significant 10% increase after delivering strong earnings, prompting investors to assess its investment viability. The company’s recent financial performance has been robust, with notable growth in its key segments.

Valuation Metrics

To determine if Disney is a good stock to buy now, it’s essential to examine its valuation metrics. The company’s price-to-earnings ratio stands at 25, slightly higher than the industry average. However, this is justified by Disney’s strong growth prospects and diversified revenue streams.

| Metric | Disney | Industry Average |

|---|---|---|

| P/E Ratio | 25 | 22 |

| Dividend Yield | 0.8% | 1.2% |

| Market Cap | $250B | $200B |

Growth Prospects

Disney’s growth prospects are promising, driven by its expanding Disney+ subscriber base and the recovery of its parks segment. The company’s strategic focus on content creation and digital transformation is expected to drive long-term growth.

Risk Factors

Despite the positive outlook, there are risk factors to consider. These include intense competition in the streaming market and potential economic downturns affecting consumer spending on entertainment.

Portfolio Fit Considerations

For investors, Disney’s stock offers a mix of growth and stability. Its diversified business model, including media networks, parks, and consumer products, makes it a potentially attractive addition to a well-rounded investment portfolio.

Conclusion: Disney Stock Forecast After Earnings

Disney’s strong earnings report has led to a 10% surge in its stock price, driven by the company’s robust performance and growth prospects. The Disney stock forecast after earnings looks promising, with the company’s diversified revenue streams and strategic initiatives expected to drive long-term growth.

A key factor contributing to Disney’s success is its Disney+ subscriber growth, which has exceeded expectations. The company’s streaming business is on the path to profitability, with Disney+ leading the charge. Additionally, Disney’s parks and experiences segment has delivered solid performance, further boosting the company’s overall revenue.

As Disney continues to execute its strategic initiatives, including content creation and digital transformation, the company’s growth prospects are expected to remain strong. Disney stock analysis suggests that the company’s stock price will continue to perform well in the future, driven by its robust earnings and growth prospects.

FAQ

What was Disney’s stock price movement after the Q2 2025 earnings report?

Disney’s stock surged 10% after the company reported strong earnings and Disney+ growth, beating analyst expectations.

How did Disney’s Disney+ subscriber growth perform in Q2 2025?

Disney+ subscriber growth exceeded expectations, contributing to the company’s positive earnings report and stock surge.

What were the key factors driving Disney’s revenue growth in Q2 2025?

Disney’s revenue growth was driven by strong performance in its Parks and Experiences segment, Media and Entertainment Distribution, and International Operations.

How is Disney’s streaming business performing in terms of profitability?

Disney’s streaming business, led by Disney+, is on a path to profitability, with the company implementing a streaming bundle strategy and cost-cutting measures.

What is Disney’s updated fiscal 2025 guidance?

Disney updated its fiscal 2025 guidance, providing revenue projections, profit margin expectations, and a capital allocation strategy that reflects the company’s growth prospects.

How does Disney+ compare to Netflix in terms of subscriber growth?

Disney+ has demonstrated strong subscriber growth, competing effectively with Netflix, with a different content investment strategy and pricing model.

Is Disney a good stock to buy now?

The decision to buy Disney stock depends on individual investment goals and risk tolerance, with the company’s strong performance and growth prospects being positive factors.

What are the main risk factors associated with investing in Disney stock?

Risk factors include competition in the streaming market, economic downturns affecting consumer spending on entertainment, and the company’s ability to maintain growth momentum.

What is the current Wall Street sentiment on Disney stock?

Wall Street analysts have varying ratings and price targets for Disney stock, with some being bullish on the company’s growth prospects and others cautious about potential challenges.

How does Disney’s content creation strategy contribute to its growth?

Disney’s content creation strategy, leveraging its intellectual property, is a key driver of growth, particularly for Disney+ and the company’s overall streaming business.