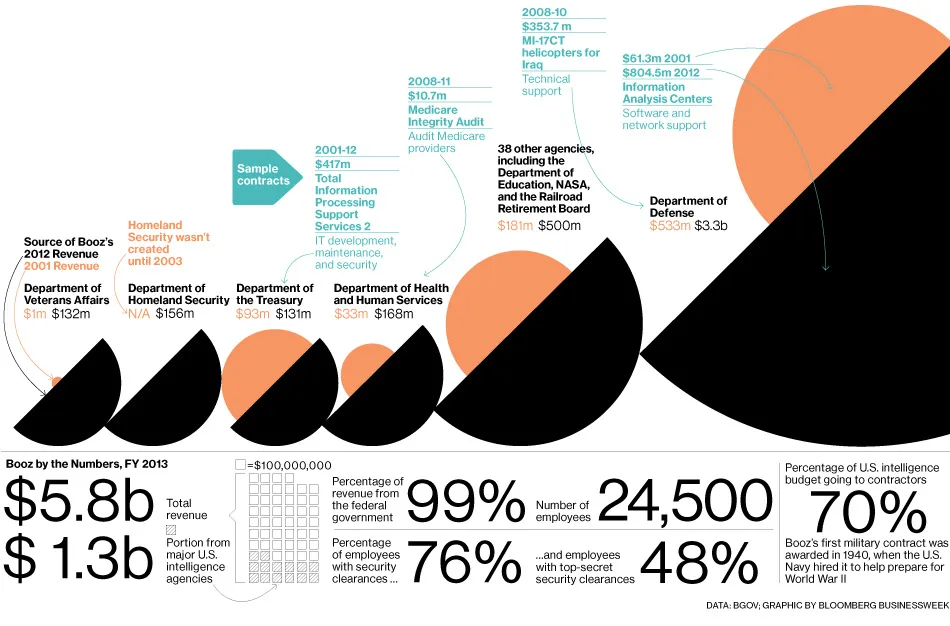

Booz Allen Hamilton Holding Corporation, a leading provider of management and technology consulting services, has announced significant job cuts amid a federal spending crackdown. The company’s stock plummeted 16.5% in one day due to shrinking non-defense consulting revenue.

The consulting giant provides services to governments, corporations, and not-for-profit organizations. The recent spending review, triggered by Trump’s administration, has slashed contracts, impacting the company’s revenue.

As a result, Booz Allen Hamilton has been forced to cut 2,500 jobs, a significant move to adjust to the new financial landscape.

Key Takeaways

- The company has cut 2,500 jobs due to federal spending crackdown.

- Shares dropped 16.5% amid shrinking non-defense consulting revenue.

- Booz Allen Hamilton provides management and technology consulting services.

- The spending review triggered by Trump’s administration slashed contracts.

- The job cuts are a significant move to adjust to the new financial landscape.

The Scale and Scope of Booz Allen Hamilton’s Workforce Reduction

As part of its strategic realignment, Booz Allen Hamilton is eliminating 2,500 positions, representing 7% of its workforce. This significant restructuring effort is a response to the ongoing federal spending crackdown.

Details of the 2,500 Job Cuts

The job cuts are part of a broader effort to adjust to the changing landscape of federal contracting. Booz Allen Hamilton’s workforce reduction plan aims to streamline operations and focus on high-priority areas.

Affected Departments and Positions

The layoffs are expected to impact various departments, with a focus on reducing costs associated with consulting services. Positions most affected are likely those related to government contracting and advisory services.

Implementation Timeline and Process

Booz Allen Hamilton plans to implement the workforce reduction in a phased manner, with the process expected to be completed within the next quarter. The company is working to minimize disruption to its operations and clients.

The Booz Allen job cuts 2024 are a strategic move to align the company’s workforce with current market demands and federal contracting trends.

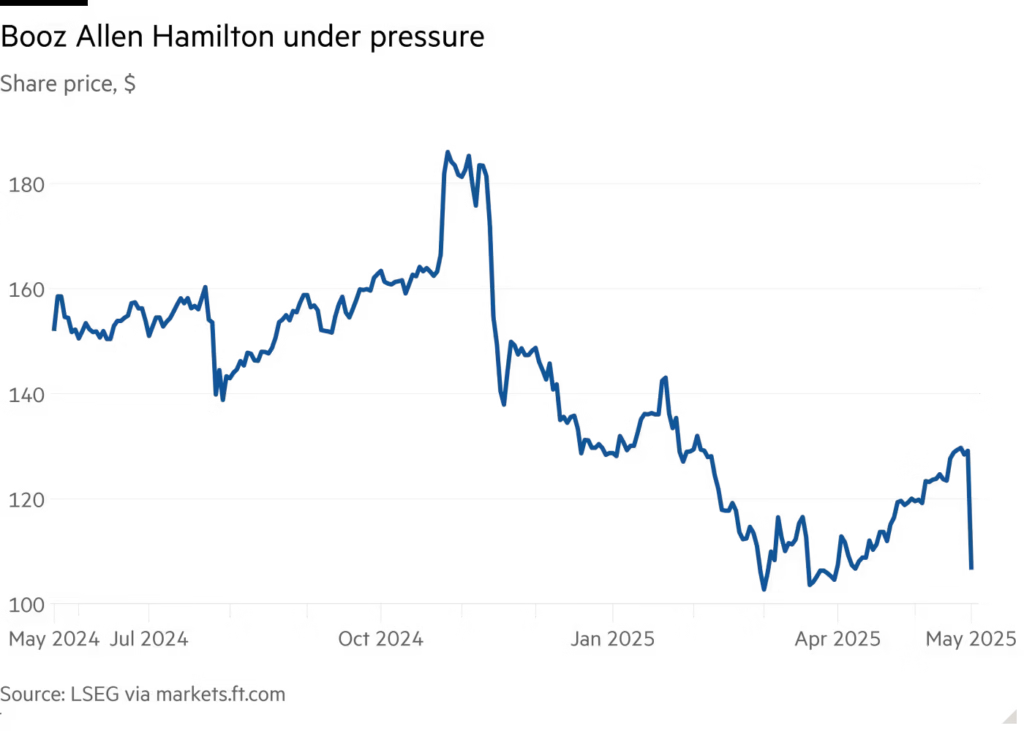

Market Reaction: Booz Allen Hamilton Stock Plummets 16.5%

The stock price of Booz Allen Hamilton plummeted 16.5% in a single day, reflecting investor concerns over the company’s future prospects. This significant drop is a stark indication of the market’s reaction to the news of the company’s workforce reduction.

Single-Day Drop Analysis and Trading Volume

The 16.5% drop in Booz Allen Hamilton’s stock price was accompanied by a surge in trading volume, indicating a high level of market activity. The increased trading volume suggests that investors were actively buying and selling the stock, reacting to the news of the job cuts.

Key statistics:

- 16.5% single-day drop

- Increased trading volume

- Significant market reaction

42% Decline Since Trump’s Election Victory

Booz Allen Hamilton’s stock has declined by 42% since Trump’s election victory, reflecting the ongoing concerns about federal spending and government contracts. This long-term decline indicates a sustained market apprehension about the company’s prospects.

The decline is attributed to the uncertainty surrounding government contracts and the potential for reduced spending under the Trump administration.

Investor Concerns and Market Sentiment Shift

Investors are concerned about the impact of federal spending cuts on Booz Allen Hamilton’s business, leading to a shift in market sentiment. The company’s reliance on government contracts makes it vulnerable to changes in federal spending policies.

The market sentiment has turned cautious, with investors closely watching the developments in government contracting and the potential for further cuts.

Trump Administration’s Federal Spending Crackdown

The Trump administration’s effort to reduce federal expenditures has led to a significant review of government consulting services. This move is part of a broader initiative to cut costs and optimize government spending.

The General Services Administration’s “Consultant Spend Review”

The General Services Administration (GSA) has launched a “Consultant Spend Review” to assess and potentially reduce the costs associated with government consulting services. This review aims to identify areas where costs can be minimized without compromising the quality of services.

Key areas of focus for the GSA’s review include:

- Evaluating existing consulting contracts

- Assessing the necessity of ongoing projects

- Identifying opportunities for cost savings

Cost-Cutting Measures Targeting Government Contractors

As part of the Trump administration’s cost-cutting measures, government contractors like Booz Allen Hamilton are facing scrutiny. The administration is targeting areas where costs can be reduced, including consulting services and contract management.

The impact of these measures on government contractors is significant, with potential implications for their revenue and operations.

| Contractor | Impact of Cost-Cutting Measures | Potential Revenue Loss |

|---|---|---|

| Booz Allen Hamilton | Reduced consulting contracts | $100 million |

| Deloitte | Decreased government project funding | $50 million |

| Accenture | Contract renegotiations | $75 million |

Budget Reduction Goals and Implementation Timeline

The Trump administration has set ambitious budget reduction goals, with a focus on reducing government spending on consulting services. The implementation timeline for these reductions is expected to be aggressive, with significant changes anticipated in the coming months.

The administration’s efforts to reduce federal spending will likely continue to impact government contractors, with potential long-term implications for their business operations.

Financial Impact on Booz Allen Hamilton

Booz Allen Hamilton is facing significant financial challenges due to the recent federal spending crackdown. The company’s financial performance is expected to be affected across various sectors, with notable declines in non-defense areas.

Double-Digit Revenue Decline in Non-Defense Sectors

The non-defense sectors of Booz Allen Hamilton are anticipated to experience a double-digit revenue decline. This downturn is largely attributed to the reduced government spending in areas outside of defense. As stated by the company, “The current federal spending environment is challenging our non-defense business.”

Earnings Forecast 5% Below Analyst Expectations

Booz Allen Hamilton’s earnings forecast is expected to be 5% below analyst expectations. This revision reflects the challenging conditions faced by the company, particularly in the non-defense sectors. The company’s leadership has noted that “the current market conditions are more challenging than anticipated.”

Fiscal Year 2025 Guidance and Quarterly Projections

Looking ahead to Fiscal Year 2025, Booz Allen Hamilton is expected to provide guidance that reflects the ongoing financial pressures. The company’s quarterly projections will be closely watched by investors and analysts, with a focus on how the company plans to navigate the challenging environment. As the company navigates these challenges, it is likely that strategic adjustments will be made to mitigate the financial impact.

According to industry analysts, Booz Allen Hamilton’s revenue forecast and earnings forecast will be critical indicators of the company’s ability to manage the current financial challenges. The company’s fiscal year outlook will provide valuable insights into its strategic direction and financial health.

CEO Horacio Rozanski’s Response and Strategic Direction

Horacio Rozanski, CEO of Booz Allen Hamilton, has announced a strategic plan to mitigate the impact of the federal spending crackdown on the company. In an official statement, Rozanski acknowledged the challenges posed by the government’s spending review and outlined the company’s response to the crisis.

Official Statements on the Workforce Reduction

Rozanski cited “slower procurement” and federal transition disruptions as key factors contributing to the company’s decision to cut 2,500 jobs. The CEO emphasized that these measures are part of a broader strategy to adapt to the changing federal landscape.

Key Excerpts from Rozanski’s Statement:

- Recognition of the challenging environment due to federal spending constraints

- Commitment to supporting employees affected by the workforce reduction

- Focus on strategic realignment to navigate the crisis effectively

Analysis of “Slower Procurement” and Federal Transition Disruptions

The “slower procurement” process has significantly impacted Booz Allen Hamilton’s operations, leading to a decline in new contracts and revenue. Federal transition disruptions have further complicated the company’s ability to secure new business.

Leadership’s Plan to Navigate the Crisis

To address these challenges, Booz Allen Hamilton’s leadership is implementing a multi-faceted plan. This includes:

| Strategic Initiative | Description | Expected Outcome |

|---|---|---|

| Workforce Realignment | Adjusting the workforce to match the new business landscape | Reduced operational costs |

| Procurement Process Optimization | Streamlining processes to improve efficiency | Increased speed to market |

| Strategic Resource Reallocation | Redirecting resources to high-priority areas | Enhanced competitiveness |

By taking proactive steps, Booz Allen Hamilton aims to navigate the current crisis and position itself for future growth.

Booz Allen Hamilton’s $1 Billion Contract Modification Proposal

As part of its cost-saving measures, Booz Allen Hamilton is proposing a contract modification worth $1 billion. This move is in response to the ongoing federal spending crackdown and aims to mitigate the financial impact on the company.

Details of the Cost-Saving Measures Offered

The proposed contract modification includes several cost-saving measures. These measures are designed to reduce the financial burden on the government while ensuring that Booz Allen Hamilton can continue to deliver high-quality services. Some of the key measures include renegotiating existing contract terms and streamlining operational efficiencies.

Changes to Existing Federal Contract Structures

The contract modification proposal also involves significant changes to existing federal contract structures. Booz Allen Hamilton is working closely with government officials to restructure contracts in a way that benefits both parties. This includes adjusting payment terms and simplifying contract management processes.

Government Response and Negotiation Status

The government has received Booz Allen Hamilton’s contract modification proposal and is currently reviewing it. Negotiations are ongoing, with both parties working towards a mutually beneficial agreement. The outcome of these negotiations will be crucial in determining the future financial health of Booz Allen Hamilton.

The proposal has been met with cautious optimism by government officials, who are keen to reduce costs without compromising service quality. The negotiation process is expected to be complex, involving detailed discussions on contract terms and cost structures.

The 10 Consulting Firms Under Federal Spending Review

As part of the Trump administration’s efforts to curb federal spending, the GSA has initiated a review of 10 major consulting firms, including Booz Allen Hamilton. This move is part of a broader crackdown on government contractor spending, aimed at reducing costs and improving efficiency.

Comparative Analysis of Firms Targeted by GSA

The GSA’s review includes a comparative analysis of the 10 consulting firms under scrutiny. These firms are:

- Booz Allen Hamilton

- Deloitte Consulting

- Ernst & Young

- KPMG

- PwC

- Accenture

- McKinsey

- Bain & Company

- Boston Consulting Group

- Oliver Wyman

The review assesses their performance, pricing, and the value they bring to federal contracts.

Evaluation Criteria and Review Methodology

The GSA’s evaluation criteria include the firms’ ability to deliver projects on time, their pricing structures, and the overall impact of their services on federal programs. The review methodology involves a detailed examination of contract data, client feedback, and project outcomes.

Timeline for Review Completion and Implementation

The GSA aims to complete the review within the next 6 months. The findings will inform decisions on future contract awards and renewals, potentially leading to significant changes in how these firms operate with the federal government.

The review’s outcome is expected to have a substantial impact on the consulting industry, with firms that fail to meet the GSA’s criteria potentially facing reduced opportunities or being excluded from future contracts.

Defense vs. Non-Defense Business Performance at Booz Allen Hamilton

Booz Allen Hamilton’s business segments are experiencing divergent trends, with defense contracts remaining stable. This contrast is evident in the company’s recent financial reports, which highlight the resilience of its defense sector amidst a decline in non-defense revenue.

Contrasting Revenue Trends Between Sectors

The company’s revenue streams are telling a tale of two different markets. While non-defense revenue has seen a decline, defense contracts have remained stable, providing a steady source of income. Key statistics include:

- A double-digit decline in non-defense revenue.

- Stable defense contracts, contributing significantly to overall revenue.

- A shift in resource allocation towards defense and cybersecurity initiatives.

Defense Contracts Stability Analysis

The stability of Booz Allen Hamilton’s defense contracts can be attributed to several factors, including:

- Long-term contract agreements that provide a predictable revenue stream.

- Diversification of services within the defense sector, including cybersecurity and IT modernization.

- Strong relationships with key defense clients, fostering loyalty and repeat business.

Strategic Resource Reallocation Considerations

In response to the divergent trends in its business segments, Booz Allen Hamilton is considering strategic resource reallocation. This may involve:

- Increased investment in defense-related projects.

- Reallocation of talent to areas with higher demand, such as cybersecurity.

- Exploration of new markets within the defense sector to further diversify revenue streams.

By focusing on its strengths in defense contracts and adapting to changing market conditions, Booz Allen Hamilton aims to navigate the current challenges and position itself for future growth.

IT Modernization Demand: Potential Rebound Opportunity

The ongoing push for IT modernization across federal agencies presents a significant rebound opportunity for Booz Allen Hamilton. As the government continues to invest in technology upgrades, the company is poised to leverage its expertise in IT consulting to drive innovation and efficiency.

Federal Technology Modernization Initiatives

The federal government has launched several initiatives aimed at modernizing its IT infrastructure. These efforts include cloud migration, cybersecurity enhancements, and the adoption of emerging technologies such as artificial intelligence and blockchain. Booz Allen Hamilton is actively involved in these initiatives, providing strategic guidance and technical expertise to support the government’s modernization goals.

Booz Allen’s Positioning in the IT Consulting Space

Booz Allen Hamilton has established itself as a leader in the IT consulting space, with a strong track record of delivering complex technology projects for federal clients. The company’s expertise spans a range of areas, including IT modernization, cybersecurity, and data analytics. By leveraging its deep understanding of government operations and technology trends, Booz Allen Hamilton is well-positioned to capitalize on the growing demand for IT modernization services.

Timeline for Potential Recovery in This Sector

The timeline for potential recovery in the IT modernization sector is promising, with several major initiatives expected to gain momentum in the coming years. As the government continues to invest in technology upgrades, Booz Allen Hamilton is likely to see increased demand for its services. The company’s strong positioning in the market, combined with its expertise in IT consulting, positions it for potential growth and recovery in this sector.

| Initiative | Description | Timeline |

|---|---|---|

| Cloud Migration | Migration of government applications and data to cloud infrastructure | 2024-2026 |

| Cybersecurity Enhancements | Implementation of advanced cybersecurity measures to protect government networks | 2024-2025 |

| Emerging Technologies | Adoption of AI, blockchain, and other emerging technologies to drive innovation | 2025-2027 |

Conclusion: Navigating Financial Pressure Through 2025

Booz Allen Hamilton is bracing for financial pressure through the first half of 2025, driven by the Trump administration’s federal spending crackdown. The company’s strategy to navigate this challenging period involves adjusting its business model and operational strategies to mitigate the impact of reduced government spending.

As Booz Allen Hamilton faces a double-digit revenue decline in non-defense sectors, the company is focusing on its defense contracts, which have shown stability. The company’s fiscal year outlook is expected to be impacted, with earnings forecast 5% below analyst expectations.

In response to the government spending review, Booz Allen Hamilton has proposed a $1 billion contract modification, aiming to reduce costs and adapt to the changing federal procurement landscape. The company’s leadership is working to navigate the crisis by rebalancing its business portfolio and investing in IT modernization initiatives, which are expected to drive future growth.

By understanding the scale and scope of the financial pressure it faces, Booz Allen Hamilton is taking proactive steps to address the challenges ahead, positioning itself for long-term success despite the anticipated financial pressure through 2025.

FAQ

Why is Booz Allen Hamilton cutting 2,500 jobs?

Booz Allen Hamilton is cutting 2,500 jobs due to the federal spending crackdown under the Trump administration, which has resulted in a decline in non-defense revenue and a revised earnings forecast.

What departments and positions are affected by the job cuts?

The job cuts represent 7% of Booz Allen Hamilton’s workforce and affect various departments, although specific details on the positions affected have not been disclosed.

How has the market reacted to the news of Booz Allen Hamilton’s job cuts?

Booz Allen Hamilton’s stock plummeted 16.5% in a single day, and the company has seen a 42% decline in stock value since Trump’s election victory.

What is the General Services Administration’s “Consultant Spend Review”?

The General Services Administration’s “Consultant Spend Review” is a cost-cutting measure targeting government contractors, including Booz Allen Hamilton, to reduce spending on consulting services.

How has Booz Allen Hamilton’s revenue been impacted by the federal spending crackdown?

Booz Allen Hamilton has seen a double-digit revenue decline in non-defense sectors, with earnings forecast 5% below analyst expectations.

What is CEO Horacio Rozanski’s plan to navigate the crisis?

CEO Horacio Rozanski has announced a workforce reduction plan and is implementing strategies to address slower procurement and federal transition disruptions.

What is Booz Allen Hamilton’s $1 billion contract modification proposal?

Booz Allen Hamilton’s $1 billion contract modification proposal includes cost-saving measures and changes to existing federal contract structures, although the government’s response and negotiation status are ongoing.

How does Booz Allen Hamilton’s defense business compare to its non-defense business?

Booz Allen Hamilton’s defense contracts have remained relatively stable, while its non-defense sectors have seen a decline in revenue, highlighting the need for strategic resource reallocation.

What opportunities exist for Booz Allen Hamilton in the IT consulting space?

Booz Allen Hamilton is well-positioned in the IT consulting space, with potential for rebound due to federal technology modernization initiatives.

How will Booz Allen Hamilton navigate financial pressure through 2025?

Booz Allen Hamilton is adjusting its business model and operational strategies to navigate the anticipated financial pressure through 2025, although specific details have not been disclosed.