Dealing with slow banking processes and fraud risks can be frustrating. Did you know that AI in banking is already solving these problems? With AI virtual agents in fintech, tasks like KYC compliance are faster, and fraud detection systems are smarter than ever.

Keep reading to see how this tech is transforming finance.

Key Takeaways

- AI virtual agents speed up KYC onboarding, cutting time from days to seconds. Tools like Optical Character Recognition (OCR) help banks like Up Bank and Tyro Payments streamline processes while following strict AML rules.

- Fraud detection is smarter with AI. Companies like PayPal improved fraud detection rates by 10%, and American Express saw a 6% boost using machine learning models. These systems flag suspicious activity in real time.

- AI-powered chatbots, such as Commonwealth Bank’s Ceba, provide 24/7 customer support for faster problem-solving. They lower costs by up to 30% while offering personalized financial advice based on user habits.

- Banks use facial recognition and computer vision for real-time identity checks during sign-ups or transactions. This reduces fake IDs and cuts errors without slowing down services.

- Ensuring data privacy laws like the Customer Data Rights (CDR) is key when using AI. Techniques like Edge AI keep sensitive data secure, reducing risks in processes such as loan approvals or fraud prevention tasks.

AI Virtual Agents in Banking: An Overview

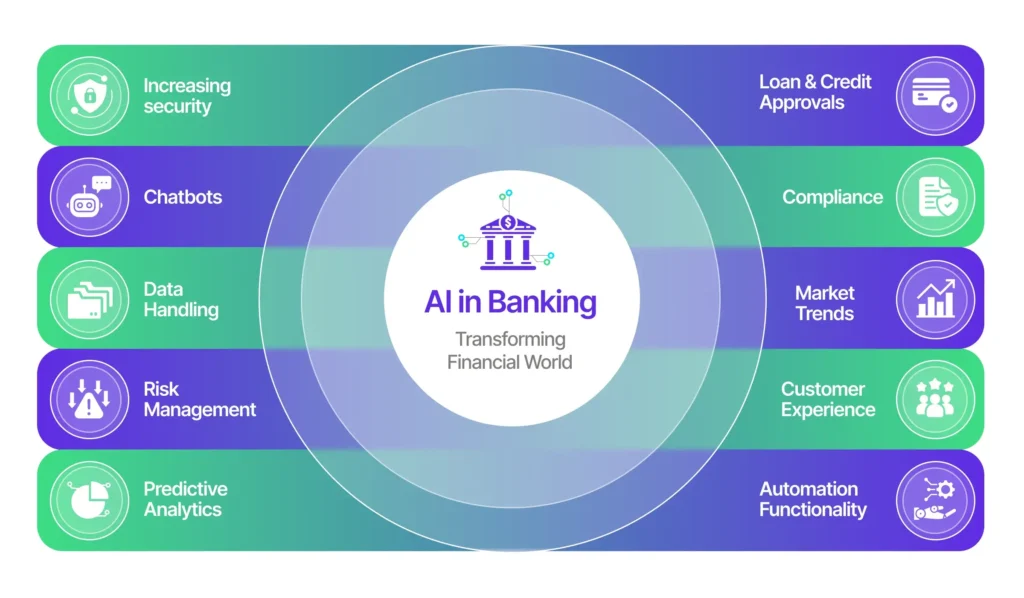

AI virtual agents are flipping the script in banking. These smart tools handle tasks faster, cheaper, and better than ever before. They are reshaping how banks interact with people, making daily processes like account help or transactions feel effortless.

In Australia alone, 72% of financial firms already use some form of AI technology! It’s no surprise since these agents offer round-the-clock support while cutting costs by up to 30%.

From answering questions to spotting fraudulent activity, their impact is everywhere in modern finance.

These intelligent assistants do more than just customer service chats. Think smarter KYC checks, quick fraud detection systems, and smoother payment methods. Banks now rely on machine learning algorithms that detect patterns humans could miss—like unusual spending habits or fake IDs during sign-ups.

This automation speeds up services without hurting accuracy. With AI adoption growing globally (Australia’s fintech sector ranks third worldwide), digital banking is entering a solid era powered by convenience and security combined!

Transforming KYC Processes with AI

AI speeds up KYC checks, making onboarding faster than ever. It catches errors and flags risks in seconds, saving banks time and money.

Automated KYC Verification

Automated KYC verification saves time and cuts errors. Banks like Up Bank used AI tools, reducing onboarding from days to seconds with Optical Character Recognition (OCR). These systems review documents quickly, flagging mismatches in real time.

Tyro Payments uses similar automated compliance tools to meet strict Anti-Money Laundering (AML) rules instantly.

AI for KYC automation also makes banking accessible to more people. It handles vast data fast, checking identities even in underserved areas. This lowers costs while boosting efficiency.

Combined with machine learning in fintech, banks gain a competitive edge by streamlining processes without sacrificing security or accuracy.

Real-Time Identity Authentication

Real-time identity authentication uses AI tools to confirm identities in seconds. Computer vision scans IDs, passports, or other documents quickly, reducing manual checks. Banks like JPMorgan Chase use these systems to streamline onboarding and tighten security.

This approach helps detect fake IDs or expired documents instantly.

Facial recognition adds another layer of protection. It compares a live selfie with uploaded ID photos to verify users are genuine. These steps cut fraud risks and save hours for both banks and customers.

By automating such tasks, banks process more clients faster without compromising safety.

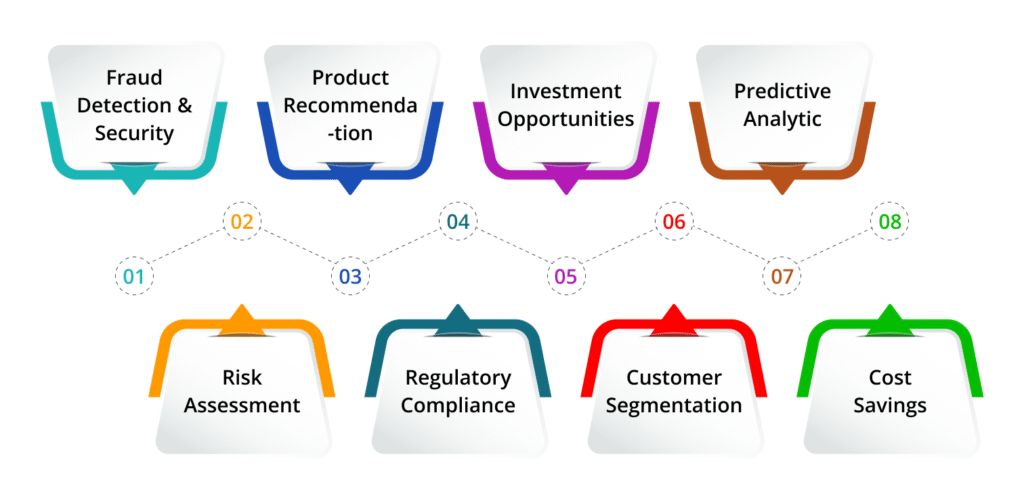

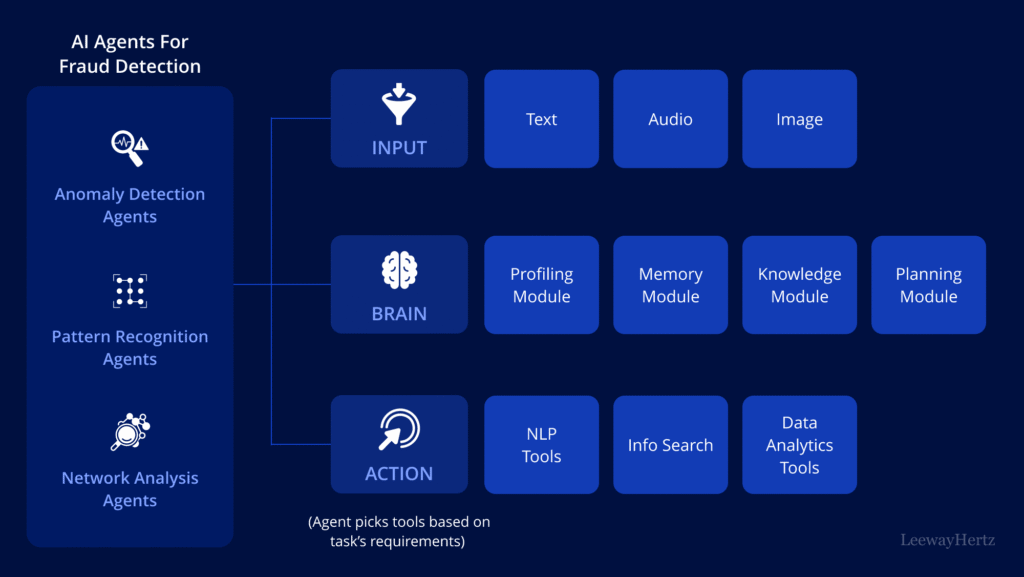

Enhancing Fraud Detection with AI-Powered Agents

Bad actors don’t rest, and neither do AI systems. These smart tools spot fishy activity fast, keeping your money safe without breaking a sweat.

Identifying Suspicious Transactions

AI fraud detection systems track transactions in real time. These systems analyze vast data sets to spot unusual patterns. For example, Xero can flag suspicious payments instantly.

Machine learning models teach AI tools to recognize subtle signs of fraud faster than humans.

Companies like PayPal improved their fraud detection rates by 10% using continuous AI processes. American Express saw a 6% boost with LSTM models. Such advanced tools adapt quickly, offering better accuracy and fewer false alerts in digital banking environments.

Preventing Account Takeovers

Hackers target weak points to access bank accounts. AI-powered security tools now block these takeovers fast. Machine learning spots odd behaviors like sudden logins from unknown devices or locations.

Banks use this data to flag and freeze suspicious activity instantly.

Chatbot banking solutions also help verify users through real-time identity checks. By analyzing patterns, AI detects phishing attempts or fake credentials quicker than humans can.

This smart banking automation protects accounts while reducing fraud risks for both banks and customers.

Smarter Financial Transactions with AI

AI simplifies payments and makes banking faster. It reduces human errors, saving time and money for both banks and users.

Streamlined Payment Processing

AI virtual agents speed up payments like never before. They use machine learning to process transactions in real time. This cuts delays and reduces errors. Up Bank, for example, used AI and cut onboarding from days to seconds using Optical Character Recognition (OCR).

With smarter systems, banks handle large volumes of payments smoothly.

These tools also make transactions safer. AI flags unusual activity quickly during payment processing. This helps avoid fraud while keeping costs low—up to 30% lower in some cases.

Integration with blockchain adds extra security layers, giving users peace of mind during every transfer or purchase.

Error Reduction in Transactions

AI reduces mistakes during financial transactions by automating processes. Intelligent financial bots check details like account numbers and payment amounts, minimizing human errors.

For example, automated banking assistants instantly flag inconsistencies before processing payments.

Banks also use machine learning to spot input mistakes in real-time. This tech ensures smoother operations, saving time for both customers and staff. Streamlined payment processing leads to fewer disputes or delays.

These advancements pair well with fraud detection methods powered by AI, making banking even safer.

AI-Powered Customer Support in Banking

Banks now use AI to answer questions, solve problems, and give advice fast. These smart tools save time and make help available all day, every day.

24/7 Virtual Assistants for Queries

AI-powered chatbots, like Commonwealth Bank’s Ceba, work round the clock. They handle customer questions instantly, reducing wait times. These bots answer FAQs about account details or services with high accuracy.

Their always-on capability ensures customers get help even at odd hours.

Virtual banking assistants also personalize conversations. They use machine learning to adapt to customer needs over time. Offering consistent support improves user satisfaction while cutting operational costs for banks.

This leads directly into personalized financial guidance powered by AI-driven systems.

Personalized Financial Guidance

AI virtual agents offer smart financial advice, making banking more personal. They analyze spending habits and financial goals to suggest better saving or investing strategies. Ignition Advice uses AI-driven solutions to guide clients, boosting engagement and trust.

This builds stronger loyalty over time.

These tools also expand credit access for underserved groups by offering fairer evaluations of risk. Fewer defaults result from this approach, helping banks grow while supporting diverse communities.

Ready for smarter fraud detection next?

Overcoming Challenges in AI Integration

Bringing AI into banking isn’t always a walk in the park. Balancing top-notch tech with strong security takes effort and smart strategies.

Ensuring Data Privacy and Security

Data privacy laws keep growing stricter. Banks using AI must follow rules like the Customer Data Rights (CDR). These regulations protect personal information and increase trust in digital banking AI tools.

Without compliance, banks risk penalties and loss of customer confidence.

AI needs large data sets to work well. This means proper safeguards are crucial. Techniques like Edge AI process data locally, reducing risks during fraud detection or loan approvals.

By limiting sensitive data transfers, it strengthens security while maintaining speed in financial operations.

Addressing Bias in AI Algorithms

AI systems in banking must be fair and accurate. Bias in algorithms can harm users, like denying loans unfairly. This happens because AI learns from past data, which may have hidden biases already.

Banks now use explainable AI tools to identify and correct bias early. These tools enable transparent checks on why an AI makes decisions. For example, if a virtual agent flags too many transactions from one group as “suspicious,” banks can examine the patterns behind it.

Addressing bias builds trust and helps meet compliance requirements in finance laws.

Conclusion

Banking is smarter, safer, and faster with AI virtual agents. They simplify KYC checks, sniff out fraud fast, and make transactions smooth as butter. These tools don’t just save time; they also boost trust between banks and customers.

While challenges exist, the benefits far outweigh them. The future of banking feels closer than ever!

FAQs

1. What is the role of AI virtual agents in digital banking?

AI virtual agents help banks handle customer queries, streamline KYC processes, and improve transactions with faster responses and smarter automation.

2. How do AI-powered tools prevent financial crime?

AI tools use machine learning to detect fraud patterns, monitor suspicious activities, and enhance compliance with financial regulations.

3. Can conversational AI make onboarding easier for customers?

Yes, conversational AI simplifies onboarding by automating KYC processes and guiding customers through steps like document verification quickly.

4. Are fintech startups using AI for security?

Fintech startups rely on AI for fraud detection, secure transactions, and ensuring compliance with ever-changing financial rules.

5. What are some real-world examples of AI in banking customer service?

Banks use intelligent chatbots to answer questions 24/7; they also provide personalized assistance during complex tasks like loan applications or account issues.