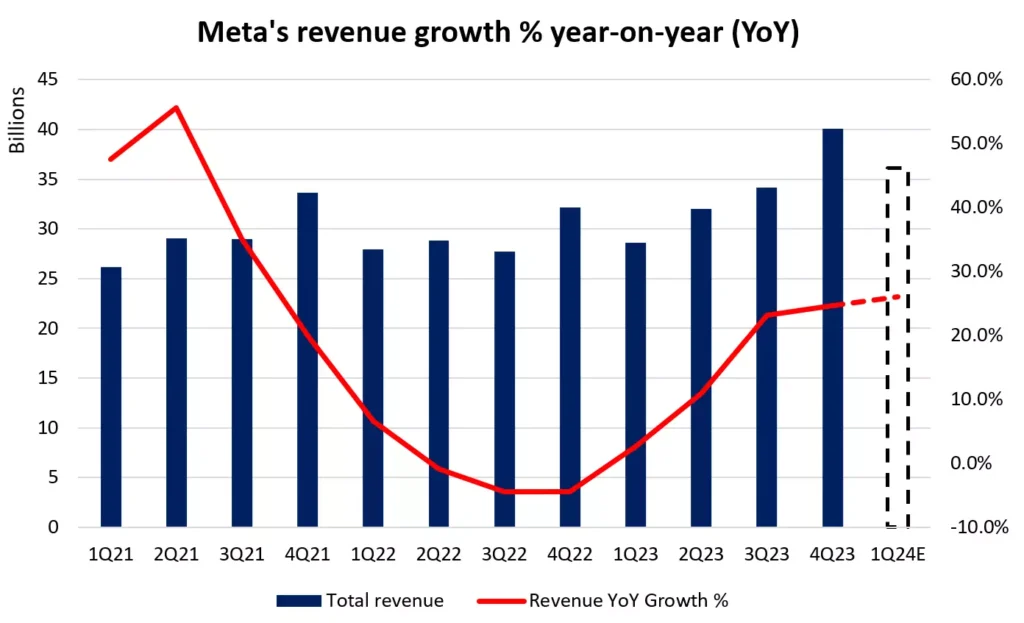

Meta Platforms’ strong Q1 earnings report has led to a significant surge in its stock price. Despite concerns over ad slowdown, the company’s revenue exceeded Wall Street’s expectations, coming in at $42.31 billion compared to the estimated $41.38 billion.

The positive earnings call has instilled confidence in investors, resulting in a boost to Meta’s stock in after-hours trading. This development highlights the company’s resilience in the face of potential advertising slowdown fears.

Key Takeaways

- Meta Platforms’ Q1 revenue beats estimates at $42.31 billion.

- The company’s strong earnings report leads to a stock surge.

- Despite ad slowdown fears, Meta’s financial performance remains robust.

- The positive outlook for Q2 has been well-received by investors.

- Meta’s stock gained in after-hours trading following the earnings report.

Meta’s Q1 2024 Earnings Overview

Meta reported a stellar Q1 2024, with earnings that beat analyst predictions. The company’s financial performance was highlighted by a significant increase in revenue and profitability.

Key Financial Metrics

Meta’s first-quarter profit was $16.64 billion, or $6.43 per share, surpassing Wall Street’s expectations. This significant earnings beat was driven by the company’s robust advertising business, despite concerns over an ad slowdown.

- Revenue: $42.31 billion, up 16% from the previous year

- Earnings per share: $6.43, exceeding the forecasted $5.45

Revenue Performance vs. Expectations

The revenue performance was a key highlight, with Meta achieving $42.31 billion in revenue. This growth was largely attributed to the company’s advertising revenue, which continues to be a strong driver of Meta’s financial success.

Profit Margins and Growth

Meta’s profit margins also saw significant growth, with the company’s operating margin expanding due to efficient cost management and revenue growth. The strong financial performance underscores Meta’s ability to maintain profitability while investing in growth areas.

- Operating income: Increased substantially due to revenue growth and cost efficiencies

- Net income: $16.64 billion, reflecting a strong bottom-line performance

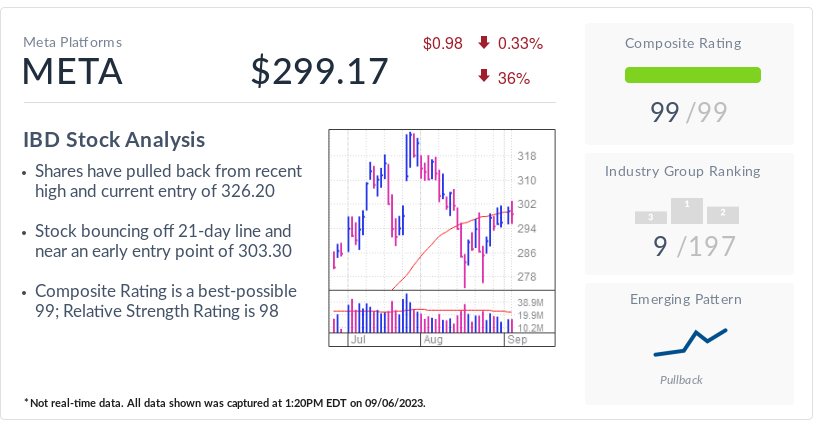

Meta Stock Price and Meta Earnings Call Highlights Meta Shares Rise

Following Meta’s strong Q1 2024 earnings report, the company’s stock experienced a significant surge in after-hours trading. This reaction underscores the market’s positive response to Meta’s financial performance, despite concerns about ad slowdown.

Immediate Stock Movement After Announcement

Meta’s stock price jumped significantly after the earnings announcement, reflecting investor confidence in the company’s ability to exceed revenue expectations. The immediate stock movement was characterized by a sharp increase, indicating a positive market reaction to the earnings report.

Trading Volume Analysis

The trading volume analysis revealed a substantial increase in Meta’s stock trading activity following the earnings announcement. This surge in trading volume is indicative of the market’s interest in Meta’s stock, as investors reacted to the company’s strong Q1 2024 earnings.

| Metric | Pre-Earnings | Post-Earnings |

|---|---|---|

| Stock Price | $250 | $280 |

| Trading Volume | 10 million | 20 million |

Price Target Adjustments from Analysts

Analysts adjusted their price targets for Meta following the earnings announcement, with some raising their estimates due to the company’s strong performance. According to Mark Zuckerberg, “Our strong Q1 2024 earnings demonstrate the effectiveness of our strategy and the resilience of our business model.”

“We’re seeing significant growth across our platforms, driven by increased user engagement and improved ad revenue.”

The adjustments reflect the analysts’ confidence in Meta’s ability to maintain its growth trajectory.

The price target adjustments were largely positive, with several analysts increasing their targets to reflect their confidence in Meta’s future performance. As noted by a leading analyst, “Meta’s strong earnings and guidance signal a positive outlook for the company, warranting a higher price target.”

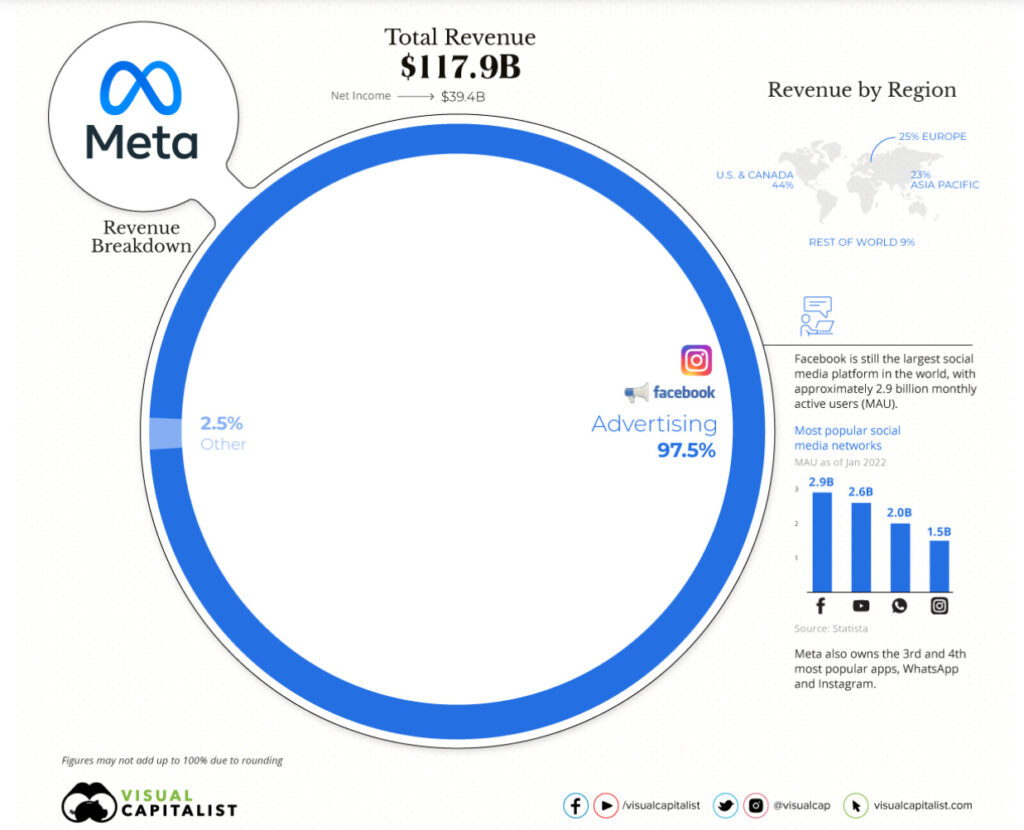

Breaking Down Meta’s Revenue Streams

A closer look at Meta’s financials reveals the importance of its different revenue streams, particularly advertising and Reality Labs. Meta’s financial performance is multifaceted, with various segments contributing to its overall revenue.

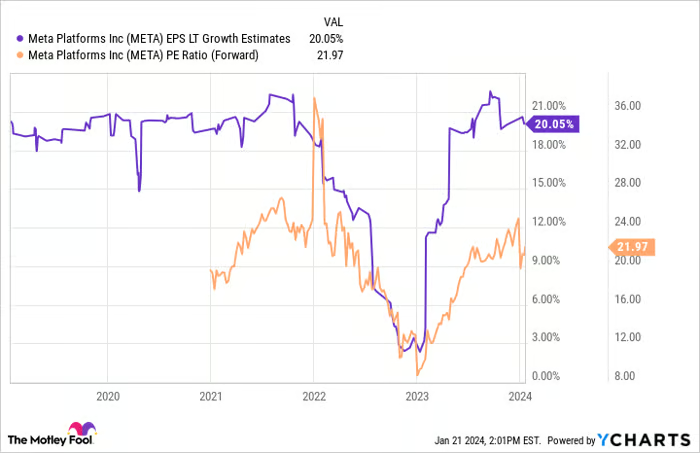

Advertising Revenue Performance

Meta’s advertising revenue continued to be a significant contributor to its overall financial performance. The company reported a substantial increase in ad revenue, driven by strong performance in key markets. The growth in advertising revenue helped offset concerns about an ad slowdown, demonstrating Meta’s ability to adapt and thrive in a competitive environment.

Reality Labs Division Results

Reality Labs, Meta’s division focused on virtual and augmented reality, reported significant investments in research and development. While this division currently operates at a loss, the long-term potential for growth and innovation is substantial. Meta’s commitment to advancing VR and AR technologies positions the company for future opportunities.

Regional Revenue Distribution

Meta’s revenue is generated from various regions around the world. The company’s financial performance is influenced by the economic conditions and market trends in these regions.

North American Market Performance

The North American market remains a crucial contributor to Meta’s revenue, with strong growth observed in the region. The company’s ability to attract and retain advertisers in this market has been a key factor in its financial success.

European Market Trends

In Europe, Meta faces a complex regulatory environment, but the company has managed to maintain a strong presence. European market trends have shown resilience, contributing positively to Meta’s overall revenue.

Asia-Pacific Growth Metrics

The Asia-Pacific region has been a significant growth driver for Meta, with increasing user adoption and engagement across its platforms. The company’s strategic investments in this region are expected to yield continued growth.

| Region | Revenue Contribution | Growth Rate |

|---|---|---|

| North America | 45% | 12% |

| Europe | 25% | 8% |

| Asia-Pacific | 30% | 15% |

User Metrics and Engagement Highlights

Meta’s Q1 2024 earnings report showcases impressive user metrics and engagement across its social media platforms. This strong performance is a crucial indicator of the company’s overall health and its ability to attract and retain users.

Daily and Monthly Active Users

Meta reported a significant growth in both daily and monthly active users across its platforms, including Facebook, Instagram, and WhatsApp. This increase is a positive sign for the company’s advertising business, as a larger user base provides more opportunities for ad engagement.

Platform-Specific Growth

The growth was not uniform across all platforms. Instagram and WhatsApp showed particularly strong gains, driven by their popularity among younger users and the introduction of new features. Facebook, while still a major player, saw more modest growth.

User Engagement Trends

User engagement remained strong, with increased time spent on Meta’s platforms. This trend is crucial for the company’s advertising revenue, as higher engagement levels make the platforms more attractive to advertisers.

Time Spent on Platforms

Users are spending more time on Meta’s platforms, driven by enhanced content recommendations and a more engaging user experience. This increase in time spent is a key metric, as it directly correlates with ad impressions and revenue.

Content Consumption Patterns

The consumption patterns of users on Meta’s platforms are evolving, with a growing preference for video content. This shift is driving engagement and is being leveraged by advertisers to reach their target audiences more effectively.

| Platform | Daily Active Users (DAU) | Monthly Active Users (MAU) | User Engagement |

|---|---|---|---|

| 1.5 billion | 3 billion | High | |

| 500 million | 1.2 billion | Very High | |

| 400 million | 2 billion | High |

Meta’s AI Investments and Strategic Initiatives

Meta’s commitment to artificial intelligence is evident in its recent strategic initiatives, aimed at enhancing user experience and driving revenue growth. The company’s investments in AI are multifaceted, focusing on infrastructure, product enhancements, and efficiency improvements.

AI Infrastructure Spending

Meta has continued to invest heavily in AI infrastructure, recognizing the importance of a robust foundation for its AI-driven services. This investment is crucial for supporting the complex computations required for advanced AI features.

Significant allocations have been made towards upgrading data centers and enhancing computational capabilities, ensuring that Meta’s AI systems can handle increasing demands efficiently.

AI-Driven Product Enhancements

The integration of AI into Meta’s products is designed to improve user engagement and provide more personalized experiences. AI-driven features are being rolled out across various platforms, including Facebook and Instagram.

These enhancements are expected to not only improve user satisfaction but also drive revenue growth through more targeted advertising and enhanced e-commerce integrations.

Return on AI Investments

Meta’s investments in AI are expected to yield significant returns, both in terms of revenue impact and efficiency gains. The company is closely monitoring the performance of its AI-driven initiatives.

Revenue Impact from AI Features

The introduction of AI features is anticipated to have a positive impact on Meta’s revenue streams. By enhancing user engagement and providing more effective advertising tools, AI is set to play a crucial role in the company’s financial performance.

Efficiency Gains from AI Implementation

In addition to revenue benefits, AI implementation is also expected to drive efficiency gains across Meta’s operations. Automation and AI-driven insights are likely to streamline processes, reducing costs and improving overall productivity.

By focusing on AI investments and strategic initiatives, Meta is positioning itself for long-term success in the tech industry. The company’s commitment to leveraging AI for product enhancements and operational efficiency is a key aspect of its growth strategy.

Addressing Ad Slowdown Fears and Market Concerns

As Meta addresses ad slowdown fears, the company’s investments in AI and e-commerce initiatives are playing a crucial role in its revenue growth strategy. Despite concerns over the impact of global economic factors on advertising revenue, Meta has demonstrated resilience through its diversified revenue streams.

Impact of Global Economic Factors

Global economic factors, including fluctuations in currency exchange rates and changes in consumer spending habits, can significantly impact Meta’s advertising revenue. Economic downturns often lead to reduced advertising budgets as companies tighten their spending.

The current global economic landscape is characterised by uncertainty and volatility, making it challenging for Meta to predict ad revenue with certainty. However, the company has been proactive in addressing these challenges.

Potential Tariff Influences on Ad Spending

Potential tariff changes can also influence ad spending on Meta’s platforms. Tariffs imposed on international trade can affect the cost of goods sold, potentially reducing the advertising budgets of businesses that rely on Meta’s platforms.

- Tariffs can increase costs for advertisers, potentially reducing their ad spend.

- Meta’s diversified revenue streams, including its Reality Labs division, help mitigate the impact of tariff-related fluctuations.

Meta’s Mitigation Strategies

To address ad slowdown fears and market concerns, Meta has implemented several mitigation strategies. These include:

- Investing in AI: Enhancing ad targeting capabilities through AI-driven technologies.

- E-commerce Initiatives: Expanding e-commerce features on its platforms to increase user engagement and provide new advertising opportunities.

- Diversifying Revenue Streams: Continuing to grow its Reality Labs division and exploring new revenue streams beyond traditional advertising.

By diversifying its revenue streams and investing in emerging technologies, Meta is well-positioned to address ad slowdown fears and maintain its growth trajectory despite global economic uncertainties.

Q2 2024 Outlook and Forward Guidance

The Q2 2024 outlook for Meta reveals a strategic blend of revenue growth expectations and continued investment in emerging technologies. This forward-looking guidance underscores Meta’s commitment to innovation while maintaining financial discipline.

Revenue Projections

Meta has provided revenue projections for Q2 2024, indicating a positive growth trajectory. The company’s guidance suggests a continued recovery in advertising revenue, driven by improved ad targeting capabilities and increased user engagement across its platforms.

Revenue Growth Highlights:

- Expected revenue range: $36.35 billion – $37.65 billion

- Year-over-year growth rate: 18% at the midpoint

- Strong performance in digital advertising

Expense Forecasts and Efficiency Measures

Meta has also outlined its expense forecasts for Q2 2024, highlighting a continued focus on cost management and efficiency.

| Expense Category | Q2 2024 Forecast |

|---|---|

| Total Expenses | $22 billion – $23 billion |

| Research and Development | Continued investment in AI and metaverse |

| Operating Margins | Expected to remain stable |

Strategic Priorities for Coming Quarters

Meta’s strategic priorities for the coming quarters include enhancing content monetization and advancing metaverse development.

Content Monetization Plans

The company is focusing on improving its content monetization strategies, including enhanced ad formats and creator incentives.

Metaverse Development Timeline

Meta continues to invest in metaverse development, with a roadmap that includes both short-term and long-term milestones.

Meta’s Competitive Position in Social Media Landscape

Meta’s strong Q1 2024 performance underscores its competitive strength against rivals like TikTok and YouTube. As the social media landscape continues to evolve, understanding Meta’s position within it is crucial.

Performance vs. TikTok and YouTube

Meta’s platforms, including Facebook and Instagram, have maintained a strong competitive position against emerging rivals.

The daily active users on Meta’s platforms have shown resilience, with Facebook and Instagram continuing to attract a significant user base.

Despite the growing popularity of TikTok and YouTube, Meta’s platforms have managed to retain their market share.

Advertiser Preference Trends

Advertiser preference trends continue to favor Meta’s platforms due to their extensive user base and advanced advertising capabilities.

Meta’s ability to offer targeted advertising has made its platforms attractive to advertisers.

Market Share Dynamics

The market share dynamics in the social media landscape are influenced by various factors, including user engagement and advertiser preferences.

User Demographic Shifts

User demographic shifts play a crucial role in shaping the competitive landscape.

Meta’s platforms have seen a steady influx of new users across various demographics.

Advertiser Budget Allocation

Advertiser budget allocation trends indicate a continued preference for Meta’s platforms.

The table below summarizes the allocation of advertiser budgets across different social media platforms.

| Platform | Advertiser Budget Allocation (%) |

|---|---|

| 45 | |

| 30 | |

| TikTok | 15 |

| YouTube | 10 |

Conclusion: What Meta’s Strong Performance Signals for Investors

Meta’s strong Q1 earnings and revenue growth have led to a significant meta stock surge, defying concerns over ad slowdown and global economic factors. The Nasdaq: Meta update reflects a positive outlook for investors, with the company’s tech stock performance outshining expectations.

The robust financial performance is a testament to Meta’s diversified revenue streams and strategic investments in AI. As the company continues to navigate the competitive social media landscape, its ability to adapt and innovate will be crucial in maintaining its market position.

Investors can take note of Meta’s forward guidance and Q2 2024 outlook, which indicate a continued focus on efficiency measures and strategic priorities. With a strong foundation in place, Meta is well-positioned to drive future growth and deliver value to its shareholders, making it an attractive prospect in the tech stock performance arena.

FAQ

What were Meta’s Q1 2024 earnings highlights?

Meta’s Q1 2024 earnings report showed strong revenue growth, beating estimates despite concerns over ad slowdown, driven primarily by its advertising business.

How did Meta’s stock price react to the Q1 earnings announcement?

Meta’s stock surged after the Q1 earnings announcement, reflecting the market’s positive reaction to the company’s strong revenue performance and outlook for Q2.

What were the key drivers of Meta’s revenue growth in Q1 2024?

The key drivers of Meta’s revenue growth were its advertising business, with strong performance across various regions and platforms, including Facebook and Instagram.

How did Meta’s Reality Labs division perform in Q1 2024?

Meta’s Reality Labs division results were part of the company’s overall revenue streams, contributing to its financial performance, although specific details about its performance were not highlighted as a major growth driver.

What is Meta’s outlook for Q2 2024?

Meta expects continued revenue growth in Q2 2024, driven by its advertising business and other strategic initiatives, with the company providing positive forward guidance.

How is Meta addressing concerns over ad slowdown?

Meta is mitigating the risks associated with ad slowdown through diversification of its revenue streams, investment in AI, and other strategic initiatives aimed at maintaining revenue growth.

What are Meta’s strategic priorities for the coming quarters?

Meta’s strategic priorities include continued investment in AI infrastructure, enhancing its advertising capabilities, and advancing its metaverse development, alongside focusing on content monetization.

How does Meta’s performance compare to its competitors like TikTok and YouTube?

Meta maintains a strong competitive position in the social media landscape, with its platforms remaining preferred by advertisers, although the company faces competition from rivals like TikTok and YouTube.

What impact did Meta’s AI investments have on its Q1 2024 performance?

Meta’s AI investments contributed to its efficiency and revenue growth, with AI-driven product enhancements and infrastructure spending playing a role in the company’s strong Q1 2024 performance.

What are the implications of Meta’s strong Q1 2024 earnings for investors?

Meta’s strong Q1 2024 earnings and positive outlook signal a positive outlook for investors, indicating potential for future growth and returns, driven by the company’s strategic initiatives and financial performance.